The fintech business has grown significantly in recent years, revolutionizing traditional banking and finance. However, as fintech firms continue to disrupt the market, they face an important challenge: regulatory compliance. To meet this challenge, a new industry has formed called Regtech. Regtech, or regulatory technology, is a term that refers to the use of new technologies to expedite and automate compliance processes, allowing fintech companies to effectively navigate complicated regulatory landscapes.

Fintech companies operate in a highly regulated environment, subject to different laws and regulations set by governmental entities such as financial authorities and regulatory agencies. These policies are intended to safeguard customers, prevent financial crimes, preserve data privacy, and promote market stability. Compliance with these standards is not only required but also vital in establishing trust and confidence with consumers and investors.

Traditional compliance approaches can be time-consuming, resource-intensive, and error-prone. With their agile and technology-driven approach, fintech start-ups recognized the need for more efficient and automated compliance solutions. They realized that traditional approaches could not handle the massive amounts of data generated in the digital age.

The Emergence of Regtech

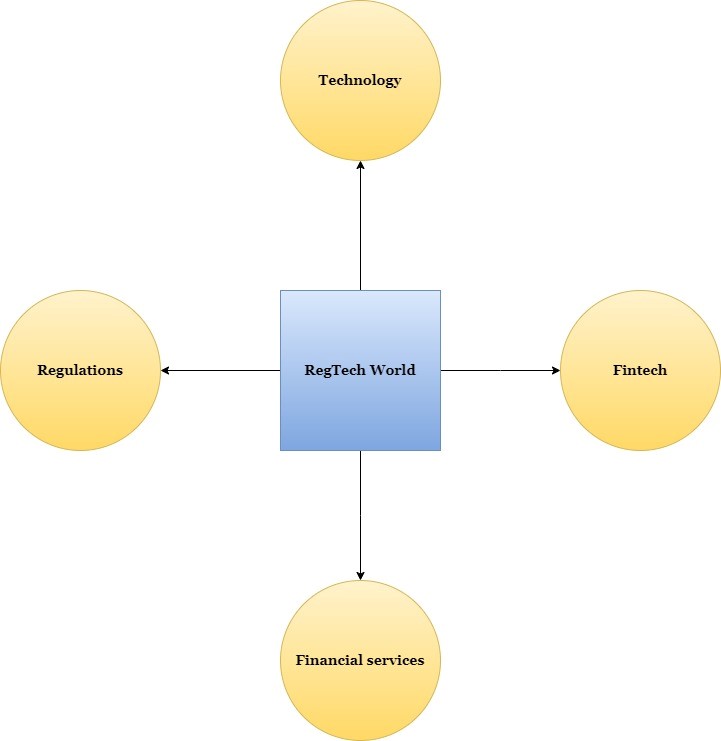

Regtech emerged as a solution to these traditional compliance approaches, employing emerging technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and big data analytics. Regtech solutions provide fintech organizations with tools and platforms to automate compliance processes, improve risk management, and ensure compliance with regulatory standards.

Benefits of Regtech for Fintech Companies

- Efficiency and Automation: Regtech solutions automate labour-intensive compliance procedures, minimizing human errors and enhancing operational efficiency. This automation enables businesses to devote resources to more strategic operations.

- Real-time Monitoring and Reporting: Regtech platforms provide real-time monitoring and reporting of compliance activities, facilitating proactive detection and resolution of compliance concerns. This assists fintech organizations in staying on top of their regulatory duties and demonstrating their commitment to compliance.

- Improved Risk Management: Regtech solutions use advanced analytics to spot possible hazards and irregularities in data, transactions, and customer behaviour. Fintech organizations can improve their fraud detection and prevention capabilities by integrating risk management tools.

- Cost Reduction: Traditional compliance procedures can be costly, particularly for small and medium-sized fintech organizations. Regtech solutions offer cost-effective alternatives by eliminating the need for manual operations and lowering regulatory penalties associated with noncompliance.

- Regulatory Collaboration and Standardization: Regtech benefits both fintech start-ups and regulatory agencies. It enables authorities to more efficiently and effectively monitor compliance, resulting in a more transparent and stable financial ecosystem. Furthermore, the industrywide use of standardized regtech solutions promotes consistency and streamlines compliance requirements for financial start-ups.

As fintech continues to disrupt the financial industry, compliance with regulatory standards remains a vital aspect of success. Regtech has emerged as a critical enabler, allowing fintech companies to manage the complicated regulatory landscape swiftly and effectively. Regtech solutions expedite compliance processes, improve risk management, and save costs by integrating cutting-edge technology. As the fintech industry evolves, the collaboration between Regtech and regulators will be critical to maintaining trust, integrity, and innovation in the financial ecosystem.