Financial inclusion refers to the process of ensuring access to affordable financial services, such as banking, insurance and credit, to all sections of society, particularly the underprivileged and low-income groups.

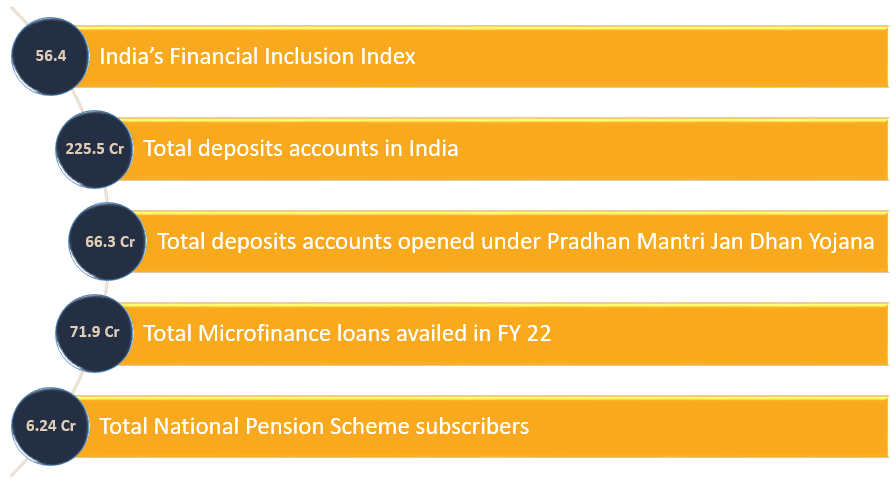

Data Points to understand Financial Inclusion

The need for Financial Inclusion

- Addressing poverty – Financial inclusion can help to alleviate poverty by providing access to formal financial services and promoting savings and investment habits among low-income households. Currently, India faces poverty in 75% of rural and 50% of urban households, totaling an official poverty percentage of 62.5%. Addressing the basic financial needs of the said population is the need of the hour to ensure we boost financial inclusion.

- Promoting economic growth – Financial inclusion can contribute to economic growth by enabling the flow of credit to small and medium-sized businesses, which are often the backbone of the Indian economy. With MSMEs contributing over 30% of the GDP, it is a pressing priority to assist them financially.

- Reducing income inequality – Financial inclusion can reduce income inequality by providing financial services to underserved sections of society, including rural areas and women. As per data, the pandemic has led to a further contraction of income and wealth in the bottom 50% of India. The top 30% own 90% of India’s wealth and interestingly, the top 10% own over 72% of India’s total wealth and the top 5% of the population owns nearly 62% of the wealth. Understanding the statistics makes us realize the staggering disparity in income.

As per the Reserve Bank of India, only 27% of Indian adults are financially literate. This makes it easier for intermediaries and informal financial systems to defraud the illiterates. However, with educational programs, this issue can be addressed and eliminated.

- Promoting financial stability – Financial inclusion can help to promote financial stability by reducing the reliance on informal and unregulated financial systems that are often associated with fraud and other illegal activities.

- Empowering individuals – Financial inclusion can empower individuals by enabling them to make informed financial decisions, access credit, and invest in their future.

The future of Financial Inclusion

The future of financial inclusion in India looks promising, with significant progress made in recent years. Putting digital transformation at the forefront by the government and financial institutions has accelerated and is further expected to accelerate inclusivity in the coming years. With MSMEs and underserved individuals steadily adopting internet banking, mobile banking, etc., a digital shift can be expected.

With Fintechs and NBFCs joining strengths, the collaboration has been beneficial for the financial domain. Better innovation with robust financial products and services that cater to the specific needs of the underserved has been introduced and executed in the market. This customization and personalization only seem to get better with time and adaption.

However, it is important to note that financial literacy plays a very critical role in everything we have spoken of thus far. Without basic awareness and literacy to make informed decisions, every other initiative may prove futile. The government, along with several initiatives, has joined forces with financial institutions to convey awareness and literacy to the last mile.

In conclusion, the future of financial inclusion in India looks promising, with the potential to improve the lives of 900 million people by providing access to formal financial services, promoting savings and investment, and reducing poverty and inequality.