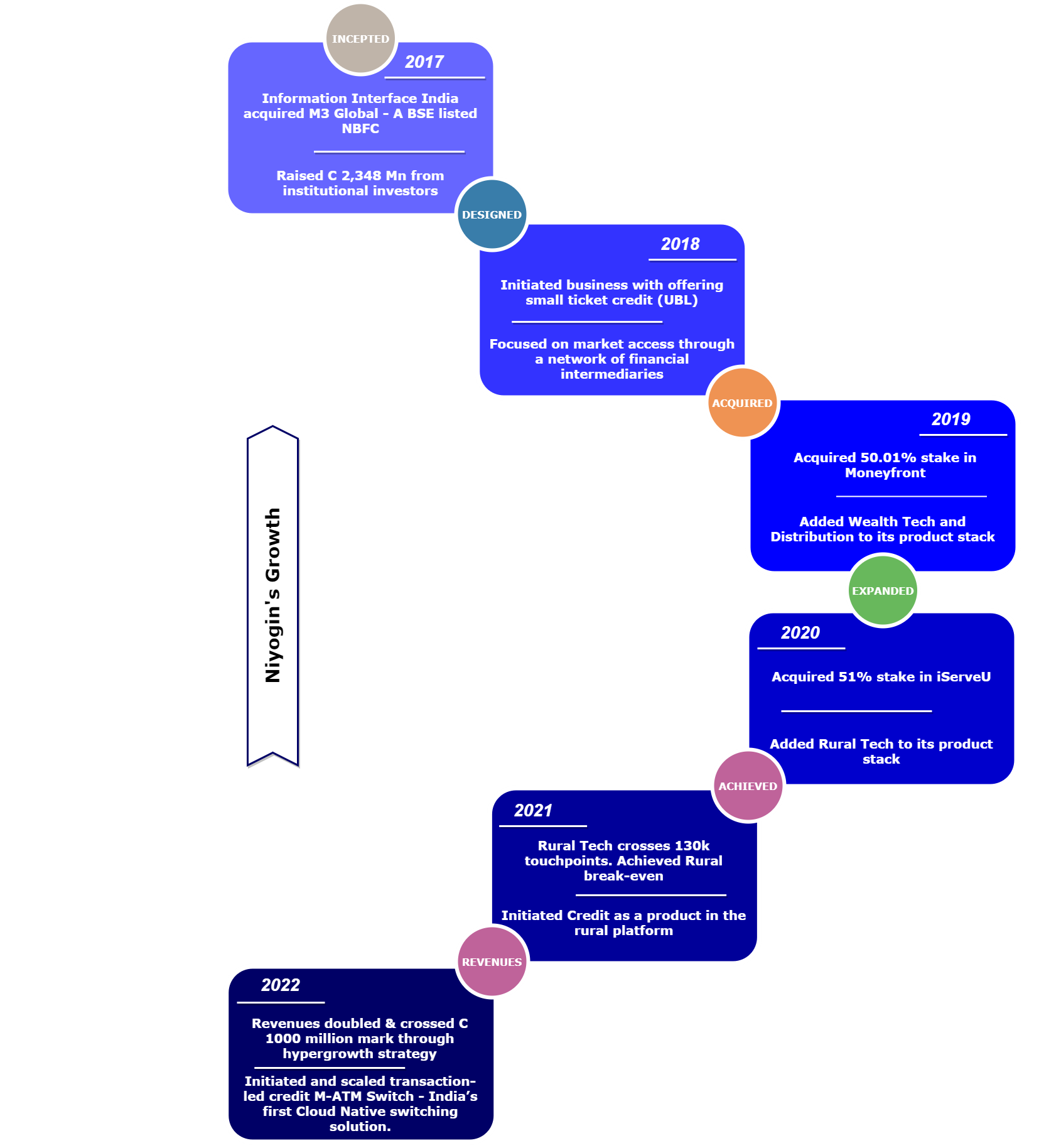

This inciting journey began in the year 2017 when two friends, Amit Rajpal and Gaurav Patankar manifested their vision of empowerment across strata through financial inclusion and equitable financial opportunities. Their core belief is that to measure the concept of growth, financial inclusion is a vital and inevitable part.

And thus began the journey of Niyogin; a Sanskrit word that literally translates to ‘Empower’. The thoughtful name and well-crafted business model mean Niyogin is always thinking ahead to adapt to changing realities and emerging needs, with innovation, flexibility and agility serving as some of its core values.

Innovation and adaptability are the cornerstones of the founding principles of Niyogin. Throughout its journey, Niyogin has strived to continuously evolve and, in doing so, has continued to deliver growth for the organization and its associated partners. It understands that these values are fundamental to its progress and, thus, is committed to reimagining itself at every juncture.

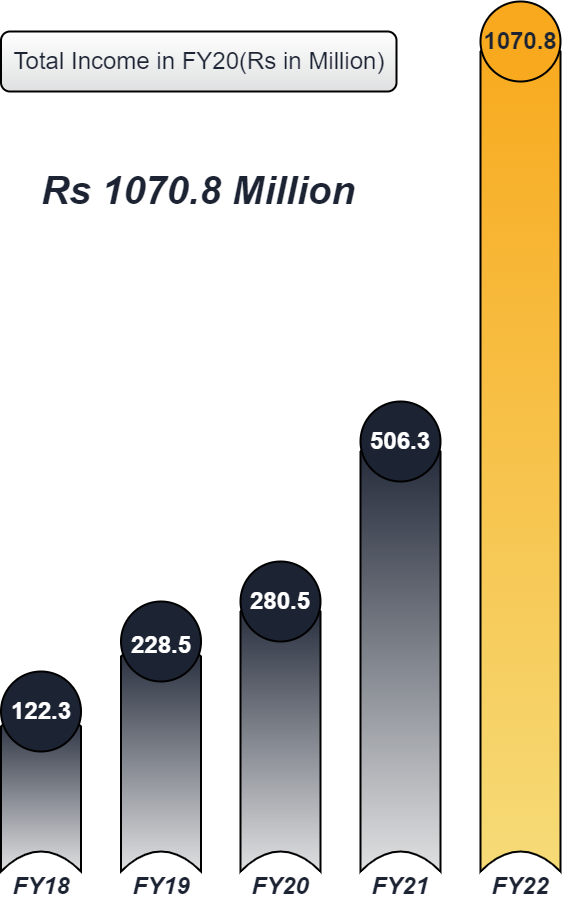

All about revenues

Niyogin witnessed an income of Rs 122.3 million in FY18, a year into its inception. Thereafter, it enjoyed a steady growth YoY ranging from Rs 228.5 million in FY19 to 506.3 in FY21. Despite the pandemic’s stir globally, Niyogin displayed an income growth in FY20 and FY21 from Rs 280.5 million to Rs 506.3 million respectively. As of date, Niyogin stands at a whopping income of Rs 1070.8 million! Owing to its deliberate strategic steps and alliances, Niyogin has been able to exhibit growth and revenues even in times of global distress.

Niyogin’s acquisitions and product stack

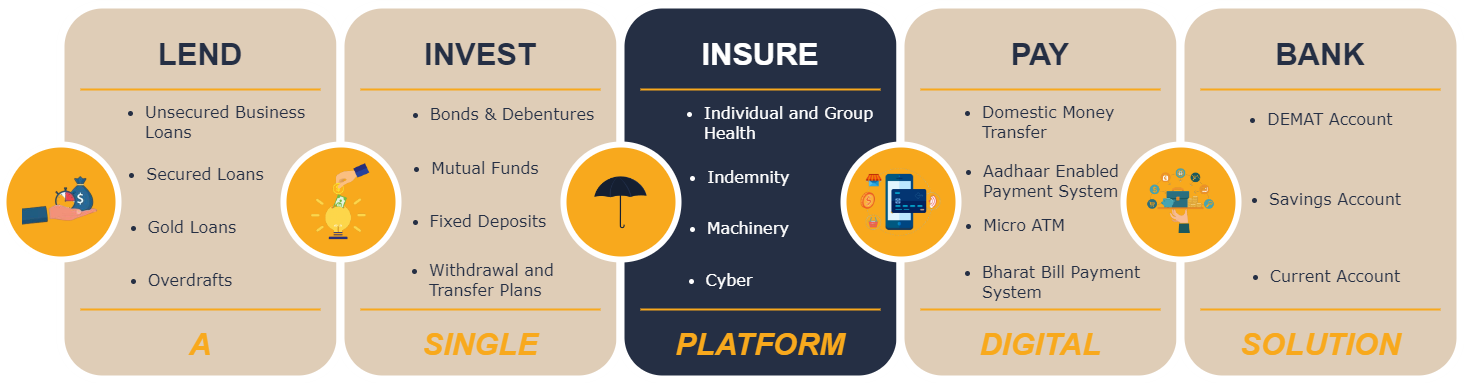

To build an ecosystem of customer-centric products and services that embraces every stratum of society under its umbrella, Niyogin gradually introduced services into its ecosystem over the years. What started in the credit segment – Unsecured Business Loans alone boast investments, insurance, banking and payment products, all on a single platform!

By acquiring two very strong visioned companies, iServeU and Moneyfront, Niyogin cemented its hold in the market. Where Moneyfront offers an automated WeathTech and Distribution (Investments) platform that ranges from mutual funds, bonds, debentures, government instruments and much more, iServeU specializes in Rural Tech. They focus on uplifting the rural area by leveraging already existing infrastructure and the consumer’s trust. With 3 Lakhs Kirana stores impaneled, iServeU services 25,000 villages with credit, MicroATM, Aadhaar-enabled payment system, Domestic money transfer and much more payment and banking services.

Financial inclusion and empowerment are Niyogin’s nucleus and every strategic move, acquisition and alliance have been made keeping the end goal in mind.

The current state

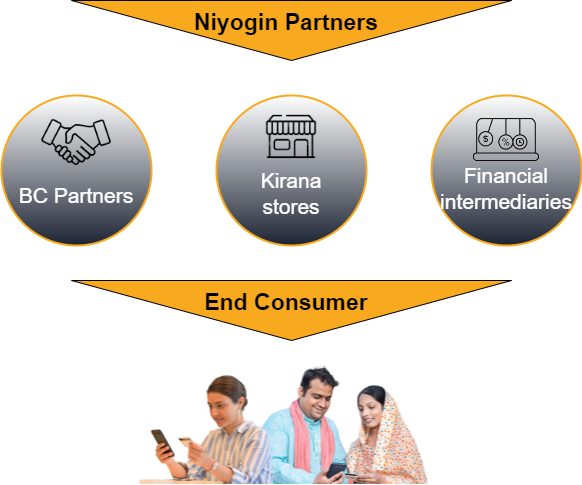

Niyogin’s mission is to provide financial access to every individual and business who find it difficult to achieve their goals due to financial constraints. In a country that has a population of 1.4 billion of which 900 million are rural and with 63 million MSMEs, India is beaming with opportunities! Many consumers and businesses are at the lower end of the pyramid and have limited to no access to financial services; that is where Niyogin steps in. With the government setting the rails with UPI and Aadhaar Stack, Niyogin leverages the said infrastructure to target potential customers through partners.

Niyogin’s business model is such that it does not directly cater to the end users but assists its partners to reach these customers by leveraging Niyogin’s technology stack. However, the game changes when we talk about rural areas. In this market, committed physical channels or pure digital channels don’t entirely work or thrive owing to high operational costs against small ticket sizes, the lack of access to smartphones and restricted knowledge in completing digital journeys.

As a technology-first platform that leverages existing physical distribution across a broad product stack with a modular orientation where Niyogin’s customers pick and choose products they are keen to build off. Niyogin leverages the “rails” that have been put in place to come together to create an exponential opportunity.

The future prospects

Niyogin has built off a financial inclusion based payments platform and is broadening its remit to include POS (Point of Sale) solutions, financial services products including loans, deposits, insurance and ultimately could also add a commerce vertical to create a comprehensive ecosystem that serves this vast market.

Niyogin firmly regards constructive feedback it receives from its enterprise customers who are market-leading institutions to deliver its vision. With a hyper growth strategy set in place for the coming years, on the urban front, Niyogin aims to solve more complex issues in terms of financial services access for micro and small businesses by building a platform centered around their trusted financial advisor.

From an organizational point of view, Niyogin has hired talents across businesses to add a fresh perspective to its existing strategies. This is a significant step for Niyogin specially to add value to relationships (financial advisors), analytics (platform) and product and automation (FI partners). Successful relationships within and outside the organization happen to be the recipe to break barriers and add value across levels.

Financial Inclusion is Niyogin’s core priority and delivering on it in an open, smart, customized, modular platform is what it aspires to achieve. Niyogin means to ‘Empower’ in Sanskrit and we are committed to its ethos. Niyogin feels increasingly confident that it is at the start of a journey where it is brimming with confidence and opportunity!