India’s Rural segment amounts to approximately 900 million individuals and massive scope of work. The Government of India (GOI) and financial institutions are working tirelessly to bring the said underserved market on a symmetrical platform of inclusivity. In recent years, financial institutions have been able to reach deep rural areas of India by leveraging the rails set by the government, for instance, UPI Lite and 123UPI. The said improvement can be noted in the growth of the Financial Inclusion Index which grew from 53.9 in 2021 to 56.4 in 2022.

Fintechs or upstarts have been active participants in this master plan. By combining technology with finance, Fintechs are making their way through various obstacles. By designing products and literacy programs apt for the target audience, they are promoting financial inclusion, freedom and empowerment.

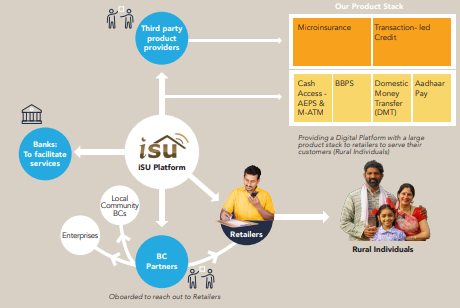

iServeU, a Niyogin subsidy, aims to power the rural segment through its Rural Tech platform. By implementing its distinguished idea of leveraging existing infrastructure and physical distribution channels, iServeU partners with business correspondents who onboard local retail stores or Kirana stores. This approach makes the intention of financial inclusion achievable as penetration into the market through trusted sources of the said community is easier. At present, iServeU has successfully impanelled more than 3,00,000 kirana stores spreading across 25,000 villages!

The intention of embracing such a distinctive method of reaching out to the rural population is the need to reduce costs. By leveraging the existing base, iServeU sizeably reduces its operational, customer acquisition and go-to-market costs.

By collaborating with partners, business correspondents and agents while equipping the impaneled retail stores with frictionless and easily accessible banking, financial and payment services, iServeU opens a world of financial services to the rural population.

As the diagram projects, iServeU’s product stack comprises of Aadhaar Enabled Payment System (AePS), Micro-ATM, Bharat Bill Payment System (BBPS), Domestic Money Transfer, Transaction-led credit and Microinsurance. These products are offered to the rural population through impaneled retail stores and facilitated by allied banks. In this entire process, third party or business correspondents play a major role.

iServeU empowering stakeholders

The Rural Tech platform empowers its stakeholders by offering –

- Income augmentation to Retailers

- Network monetization for Partners

- Optimize market access and product delivery for Banks

- Customer-centric approach that enables a tech-driven environment for the Customers

- Impact on the Rural areas as a whole

- Empowering Micro-businesses through micro-credit

iServeU’s entire product service activity is digitally driven.

Range of Products

- Aadhaar Enabled Payment System (AePS)

Considering a significant chunk of individuals residing in rural areas have limited access to education and therefore find it difficult to adapt to the concept of digital transactions, iServeU presents them with an opportunity called AePS. Through fingerprints or an Aadhaar card, individuals can now make quick cash withdrawals, make balance inquiries and much more.

- Micro-ATM (m-ATM)

An equivalent of AePS, m-ATM allows individuals to withdraw cash and enquire about their bank balance. However, in this case, they require a debit card. iServeU equips its impaneled Kirana stores with an android app that has a card reader embedded within to make these transactions possible.

- Bharat Bill Payment System (BBPS)

By onboarding over 100 recharge and bill operators, iServeU ensures the rural population can go digital while making payments. It lets them digitally make instant mobile, landline, electricity, broadband, water and gas bill payments. The interconnected bill operators ensure that these services are automated and uninterrupted.

- Direct Money Transfer

India has about 450 million internal migrants and Domestic Money Transfer is an intrinsic part of them. Migrants often rely on unmonitored methods of money transfer and therefore are often scammed by intermediaries. iServeU offers a regulated method, i.e., Domestic Money Transfer service to migrants where their money is transferred to their family members securely. Furthermore, the elimination of an intermediary has played a big role in limiting fraudulent activities.

- Micro-credit

In terms of micro-credit or loans, rural areas are severely underserved. Owing to the lack of accessibility coupled with the risks associated with rural lending, financial institutions are apprehensive to venture. However, 52.3% of the total MSMEs are hosted in rural areas making the said audience a potential target audience. Taking this as an opportunity, iServeU now offers micro-loans to businesses in rural areas with limited access to financial services.

- Micro-insurance

The rural population majorly falls in the low-capita income threshold along with having limited financial literacy. This makes it impossible to weigh them at par with services offered to the urban market. iServeU offers the rural market micro-insurance where they can insure their assets at affordable prices from trusted sources near them.

iServeU’s growth chart

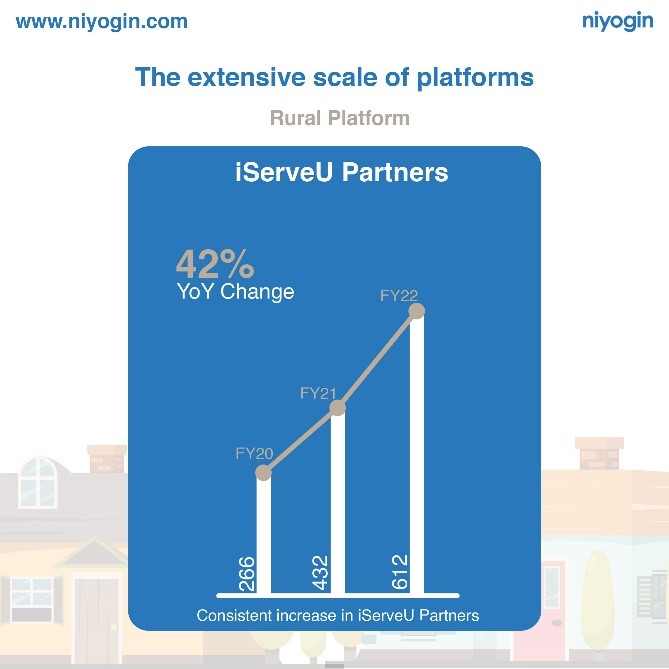

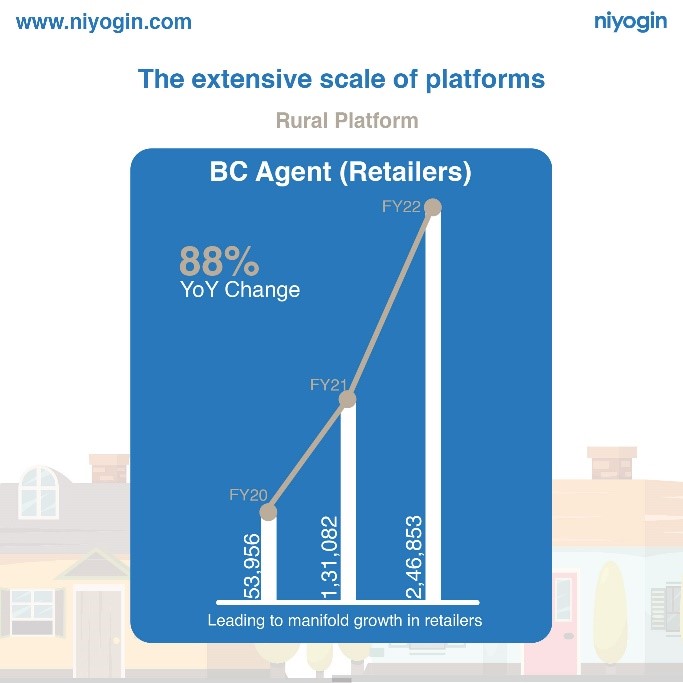

Partners

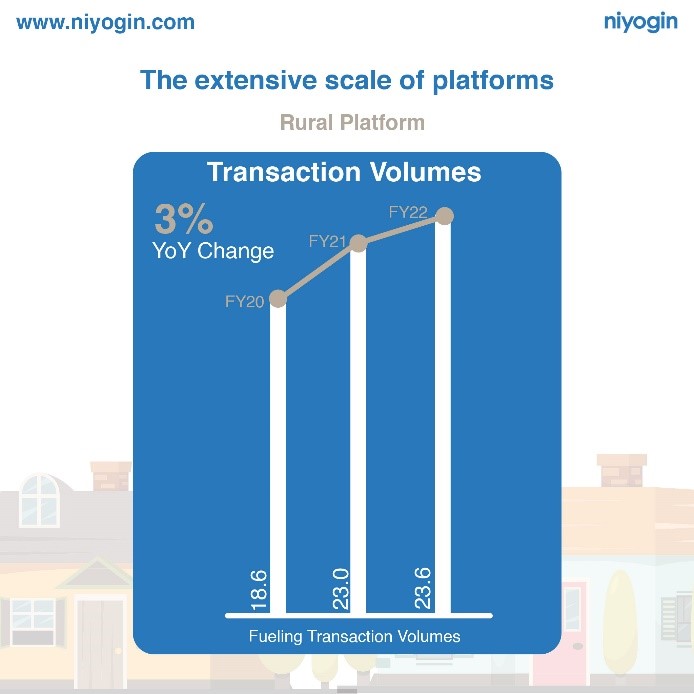

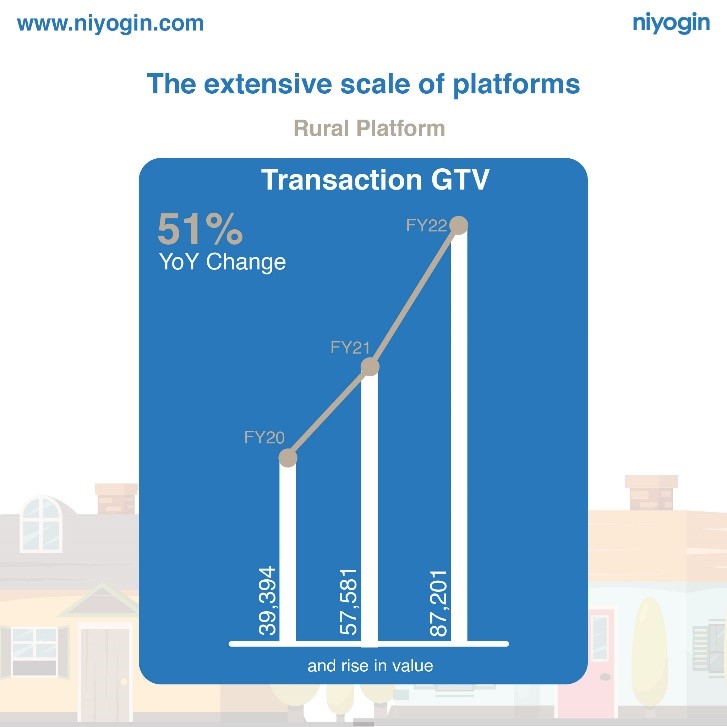

iServeU has developed manifolds in the past years and currently holds a retailer network of 2,46,853 individuals. The Gross Transaction Value (GTV) of the Rural Tech platform was C 87.2 billion in FY22, up 51% YoY from C 57.6 billion in FY21. The overall growth in iServeU’s model planning, partners, retailers, etc., indicates a positive trajectory further toward complete financial inclusion!

iServeU has developed manifolds in the past years and currently holds a retailer network of 2,46,853 individuals. The Gross Transaction Value (GTV) of the Rural Tech platform was C 87.2 billion in FY22, up 51% YoY from C 57.6 billion in FY21. The overall growth in iServeU’s model planning, partners, retailers, etc., indicates a positive trajectory further toward complete financial inclusion!