The year 2019 and forward witnessed an impact never anticipated or felt before globally. It sent out waves of disruption for individuals, society, businesses and the economies across the globe. Where a majority of individuals, businesses and economies grappled, a few thrived therein. A specific domain that witnessed a transformation has been the insurance industry. As economies recover from the pandemic, insurance companies will face challenges but also experience newer opportunities in the medium to long term.

Source: https://www.journal.riverpublishers.com/index.php/JGEU/article/view/2890/2099

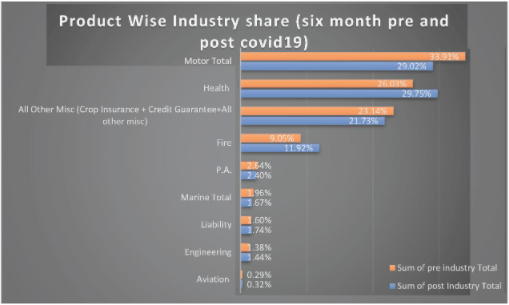

The above graphs show that Motor Insurance that falls under General Insurance dominated the market in the pre-Covid era which deflated to 29.02% post-Covid-19. The sector has seen a dip due to a halt in the purchase of new vehicles since and after Covid-19 struck.

On the other hand, the health insurance sector has seen a boost in purchases since Covid-19 has changed perceptions drastically and helped people realize the importance of health insurance.

Source: https://www.journal.riverpublishers.com/index.php/JGEU/article/view/2890/2099

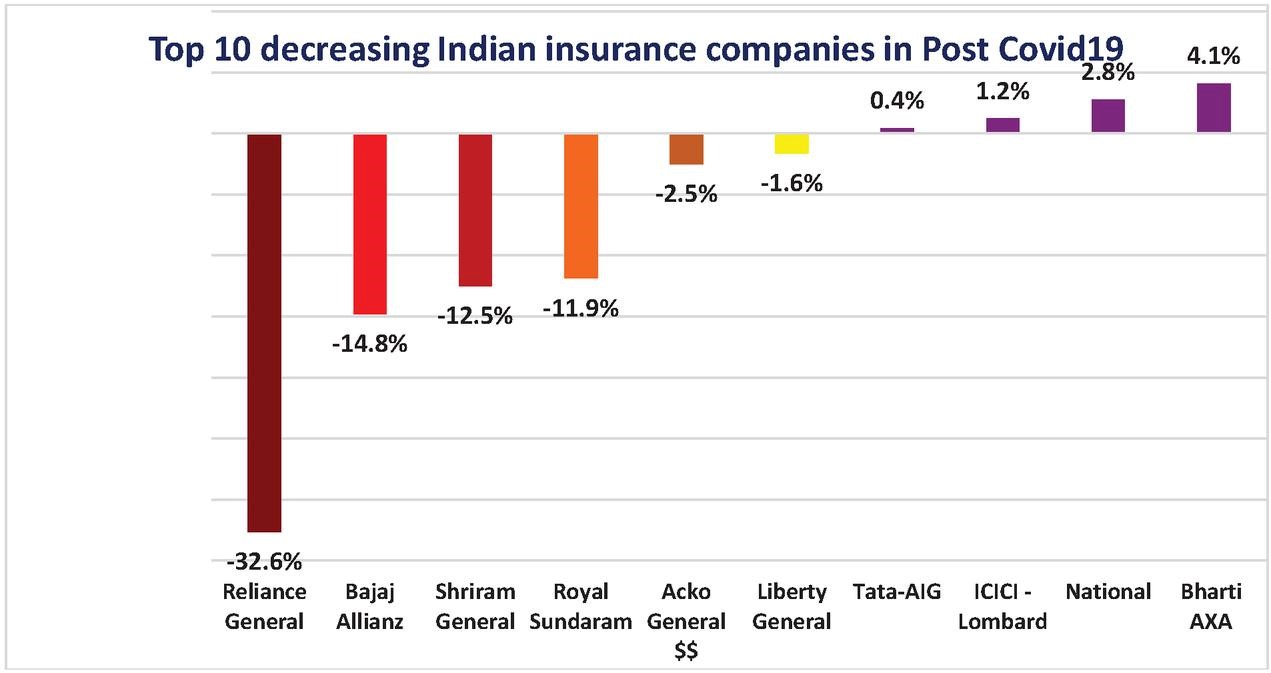

The pandemic has also turned the tables for several leading insurance companies like Reliance General, Bajaj Allianz, Shriram General, etc. While late acceptance and adoption of changes may have been a reason for their falter, other insurance companies like ICICI Lombard, Bharti AXA and Tata AIG saw positive growth in the market.

Domain-specific insurance study-

General Insurance

The impact on general insurance providers has varied depending upon the products it offered. While travel, event, trade credit, motor, etc. have experienced more loss than profit owing to restrictions and revised regulations, it has allowed GI insurers to analyze and understand the change in perception and devise customer-centric offerings that have completely digitized their platform and journey.

From a business continuity perspective, there have been large volumes of claims initiated but insurers must consider potential exclusions in government policies to assess legitimate claims. Moreover, the volatility in the overall financial market has not converted the same impact in the general insurance sector as yet.

Life & Pensions

With the pandemic’s impact on the overall economy around the globe, the spending power has reduced significantly since the outset of Covid-19. Life insurance has not seen the kind of increase it had anticipated owing to Covid-19 due to its coverage policies which held an age limit. Pensions on the other hand have witnessed a significant drop in interest rates thereby reduction in their market value.

Health Insurance

Health insurance policies have seen a mixed impact due to different coverage policies. A lot of policies do not cover basic Covid-19 treatment while many have a hard cap on the amount that can be insured along with an age limit. Moreover, the increasing trend in mutations and infections has discouraged insurers to devise plans that cover Covid-19 owing to the possibility that it may be a loss-making proposition for them in the long run. Government and private businesses are offering better rebates and credits to citizens and employees, respectively, than insurance companies.

Reinsurance Reinsurers

The reinsurers will be impacted the same way as insurers in terms of potential growth and risk associated with it. It may more or less differ on demographic but the larger picture will remain the same. On the Life and Pensions front, the mortality rate will determine the growth of the business whereas, on the General Insurance front, the coverage policy, government regulations and changing dynamics of ongoing events will determine the growth.

Conclusion

Since the outset of the pandemic, insurance companies have actively adopted a complete digital journey which has led to crucial changes in operations like data storage and management. This has compelled insurers to be more proactive and transparent while the competition and government regulations have paved the way for more customer-centric policies.