India’s Finance Minister Nirmala Sitharaman presented the Union Budget 2022-23 in Parliament on the 1st of February, 2022 where she disclosed key highlights of India’s plans toward being a financially inclusive country.

The focal concern has always been financial inclusion since it is directly related to the growth of an economy. The Budget 2022 speaks largely of how the Government of India plans to empower the underserved by introducing 75 digital banks in 75 districts by scheduling commercial banks to encourage digital payments in areas otherwise not equipped enough to facilitate it.

Moreover, the fabrication of the Digital Rupee through blockchain technology will further the cause of financial inclusion owing to elements like widespread acceptability, a robust backup, risk containment for financial institutions, etc. With India’s anticipated growth highest among all major economies, it is time to further the growth by keeping digitization at the forefront since the goal is to complement macro-growth with micro-all-inclusive welfare.

Interestingly, to implement and ensure that these commercial banks can set up and run seamlessly, 100% of 1.5 lakh post offices will come into the core banking system, a noteworthy decision by the government of India. The system of post offices is widespread in rural India and leveraging their services will benefit the cause in many ways. The intervention of the government will streamline the process, safeguard all stakeholders involved and impanel more points of service than private entities can.

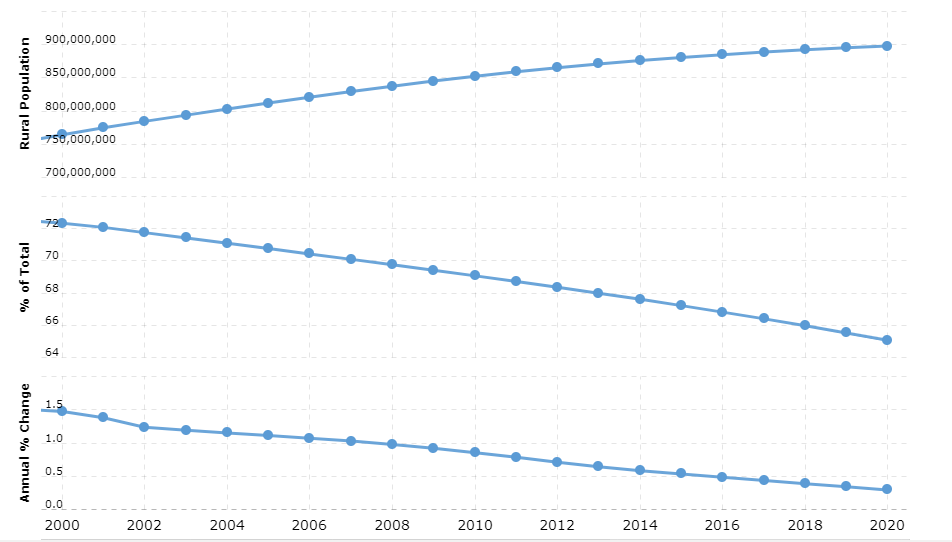

With an 800+ Mn rural population and a growth rate of 17.64% in the last decade, 68.84% of India’s total population reside in rural areas and empowering them through rural inclusion is the need of the hour. Farmers, laborers, women and senior citizens are the most underserved segment of the society with little or no financial assistance and literacy.

Source: https://www.macrotrends.net/countries/IND/india/rural-population

The Flip-side

While the government has been lauded for certain aspects of the Budget 2022, a surcharge on long-term capital gains at 15% and income tax on digital assets at 30% quivers the acceptability of certain investment options like cryptocurrency. Moreover, although the government has vowed a stable and predictable tax regime, citizens are divided over the outcome.

Conclusion

The Budget 2022 has potential if implemented with a proper amalgamation of traditional and new age banks as the long-term goal is and must be a financial landscape that is beneficial across sections of the economy.