The Fintech ecosystem is constantly reshaping and redefining traditional ways. The transformation in the financial arena is at an important stage, especially since the digital modernization of how we control and manoeuvre our finances. The noteworthy point amidst this whole transformation is how the government is not only accepting this revolution but also building sandboxes to further the growth. The reforms and assistance from the government have set the disruption in motion!

The financial ecosystem has spread its branches to various financial solutions and no longer are known only for financial assistance. They’ve evolved with technology-backed solutions that heavily rely on data, analytics and metrics to ensure a smooth customer journey while providing an array of financial services.

The Internet has played a significant role in bringing this transformation to ease our lives; an element Fintech has leveraged the best to its benefit. Fintech has brought financial solutions to our fingertips. The evolution is set to break bigger financial barriers and here are a few key trends in the Fintech domain we can watch out for –

WealthTech

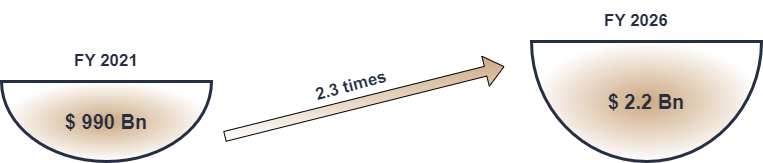

The estimated value of total equity in the Indian stock market was US$ 990 billion in FY2021, and it is expected to expand 2.3 times to US$ 2.2 billion in FY2026. WealthTech appears to be a lucrative business potential in India, thanks to expanding literacy, awareness and demand for financial assets, the addressable market has increased significantly over the years.

InsurTech

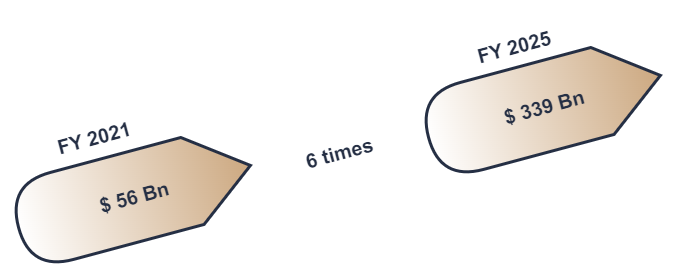

Insurance technology is the fastest-growing Fintech subsector in terms of market size. The addressable market is expected to grow around 6x from US$ 56 billion in 2021 to US$ 339 billion in 2025. For the next three years, the fast adoption of non-life insurance, which covers health, education, vehicles, and other areas, will drive the growth of this segment.

Fintech SaaS

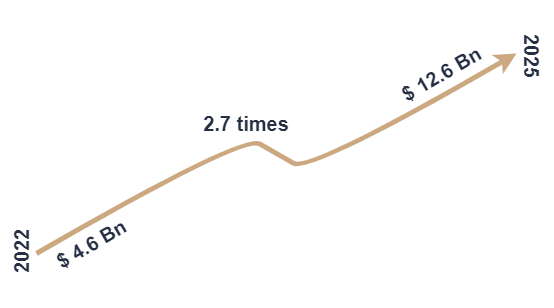

The Covid-19 pandemic boosted the adoption of digital financial products and services among Indian SMEs, resulting in increased demand for Fintech SaaS solutions for app-based accounting and bookkeeping and no-code payment aggregation. In the following three years, India’s fintech SaaS industry is predicted to grow by 2.7 times, from US$ 4.6 billion in 2022 to US$ 12.6 billion in 2025.

Buy Now Pay Later (BNPL)

BNPL enables payment for goods and services. It is a method of short-term financing allowing consumers to make instant online or offline purchases and pay for them at a future date. The model has witnessed an increase in adoption among varied sectors including Fintechs and banks. BNPL is expected to grow at a CAGR of 45% touching US$ 15 billion and account for 9% of all e-commerce payments by 2024. The underlying vectors are supposed to be India’s large addressable market, low retail credit penetration and consumption-oriented mindset.

Market Consolidation

The higher a company’s market share, it stands to reason, the better its chances of a successful IPO, as it boosts investor confidence. In fact, significant market share is one of the key factors used by experts to measure a company’s competitive position. The current Fintech space is highly fragmented; hence, a flurry of M&A deals is expected to come about. Furthermore, the need for full-stack solutions to quickly acquire potential clients and new markets is expected to spur the top players on an acquisition spree.

Blockchain

Blockchain; a salient fragment of Fintech, has proven its potential for mass adoption in workflow dynamics. Its ‘highly secure’ characteristic has allowed its quick deep penetration into the financial ecosystem and is considered one of the most trusted technologies that enable safe, convenient and regulation-compliant transactions and investments. Quoted by our Indian Finance Minister, Nirmala Sitharaman, “use of blockchain technology will rise by about 46% in the next few years.”

Major businesses are set to embrace blockchain technology to ensure a technology-led safe expansion of their businesses.

These major trends can be a defining point for the financial ecosystem in the coming years given the awareness and adoption rate of the said trends.