India, a hub of technology and innovation, counts as the second-largest country in terms of population. With 138 crore Indians scattered in urban and rural areas, India is known to be rich not only in its resources but also opportunities.

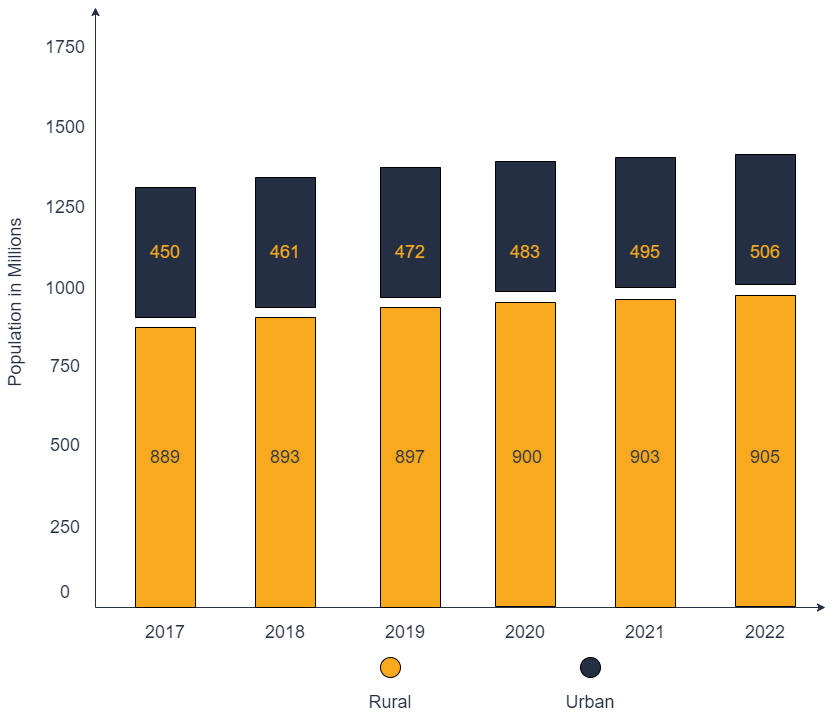

Taking a look at Urban and Rural population

As per statistics, along with India’s overall population, the rural population of India has also been on a steady growth showing an average of 0.32% YoY. The rural population in 2020 was close to 900 million compared to 905 million in 2022; an increase impossible to go unnoticed. Recognizing this growth and the fact that the rural population is underserved, the government of India and financial institutions are making an observable effort to bring them under one wing of financial inclusivity.

Niyogin’s Urban Presence

As one of its kind public listed Fintech, Niyogin’s mission is to provide cost-effective financial access to 64.61% rural population along with 35.39% urban population. The intention is to leave no segment underpenetrated or underserved giving equitable financial opportunities to every segment of society. Furthermore, a measurable consideration is also given to enhance MSME growth within India through financial assistance. Niyogin’s product range in this case is more nuanced and tailor-made to be able to create a competitive proposition in a more crowded, better-served urban backdrop.

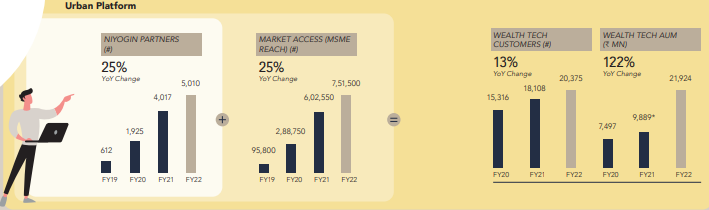

Niyogin’s Urban Growth

Owing to Niyogin’s extremely customer and impact-centric service stack, partners and products, it has been able to ascend step by step effectively. The given chart gives a glimpse of Niyogin’s overall growth in terms of partners, market access, wealth tech and AUM.

Niyogin’s business model has been built to deliver platform infrastructure play at scale and cannot be measured using traditional yardsticks. Simply put, our stakeholders should assess the scale and reach of our platforms, as well as the resulting revenues, which are a mix of fee and transaction-based variables.

The government of India has set the rail to let the train run for financial institutions looking to cater to the rural and MSME segment of India. The introduction of UPI and Aaadhar stack has acted as a foundation for impact-centric Fintech like Niyogin to cater to a larger audience. Moreover, setting up a sandbox for Fintechs to launch their experiments has enabled many innovators to design, test and launch services that promote financial inclusivity.

Through a partnership-led model that includes financial advisors, business correspondents, channel partners, banking institutions and other organizations, Niyogin reaches a wider audience by offering its partners their technology stack and distribution access via channel partners ensuring financial services to a larger audience.

Niyogin’s Rural Presence

Niyogin’s subsidiary, iServeU, plays a major role in building the rural market. Comprehending the limitation of committed physical or digital channels due to high operational costs and lack of smartphones, respectively, iServeU has built a technology platform that leverages existing physical distribution channels to tap its target audience. It offers a broad product stack with a modular orientation where individuals pick and choose products they are keen to build off.

Constant R&D and innovation help us understand customer pain points, needs and preferences to build products and services most suitable to the said segment. The aim is to add value to the process through relationships; financial advisors, platform and product and automation. The mentioned combination can help break barriers and add value across a range of products to help serve individuals better and comprehensively while ensuring steady growth for the organization.

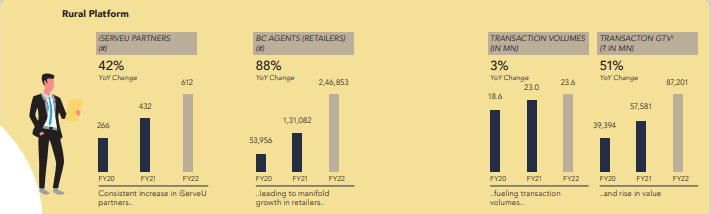

Niyogin’s Rural Growth

Given that Niyogin’s business model through iServeU is unique in its way to create and sustain in a primitive segment, i.e. rural area, its essential to continuously generate alliances to widen its reach. The given chart shows positive growth across partnerships, transaction volumes and GTV.

Financial Inclusion is Niyogin’s core priority and delivering on it in an open, smart, customized, modular platform is what we aspire to achieve!