The retail loan industry in India is growing rapidly. Compared to March 2021, the retail loans increased by 50% in March 2022. NBFCs are mainly responsible for this huge surge in the growth of personal lending. Issuing credit cards also grew by 13%.

Lenders are more willing to increase loans and credits mainly because of the change in the credit underwriting process. From March 2021 to March 2022, ₹24 crore loan was disbursed.

Traditionally, credit limit evaluation is a manual process. People looked at income slips, loan repayment receipts, and other documents to evaluate the credit limit of a person. This type of evaluation was heavily biased and based on the individual’s perception of lending. For example, two businesses in Delhi and Jabalpur would not get the same credit limit even if their income and financial status is the same. Geographical locations too played a critical role in credit limit because someone from Delhi will get a higher credit limit than someone from Jabalpur.

Modern and technology-based credit evaluation approach takes the guesswork out of the process. Standardized metrics are used and numerous different financial parameters are considered for approving credit limits.

Now, people in second-tier cities will also have access to higher credit limits, irrespective of where they are located. Fintech companies use advanced automated APIs to evaluate creditworthiness solely based on financial status. This has allowed financial institutions to offer loans symmetrically throughout.

Credit Risk Evaluation Benefits For Banks

Credit risk evaluation models that rely on historical data are inaccurate and outdated. Improved and streamlined evaluation models are the need of the hour for banks and NBFCs that are competing to improve loan offerings. Automated evaluation models can predict customer behaviors and tap into new data sources. It opens up new market segments, increasing the reach of financial institutions.

- Revenue increase – When the new dynamic model of credit underwriting is employed, data from multiple sources are fetched to calculate creditworthiness. Based on new models, banks can increase their revenue by 5% to 15%. This is possible by lowering the cost of acquisition, increasing acceptance rates, and offering a good customer experience.

- Reduce credit-loss rates – If the evaluation model can predict and pick out customers more likely to default, banks can reduce their credit losses by 20% to 40%. This can greatly help banks to improve their capital and diversity service offerings.

- Improved efficiency – Automated data extraction, evaluation ML models, and case prioritisation can improve banking efficiency by 20% to 40%. Low-risk cases can be processed quickly. High-risk cases are analyzed more thoroughly based on improved evaluation models.

How To Implement New-Age Credit Evaluation Models?

Fintech in the banking sector involves automating banking processes to create an agile environment. The best way to develop a credit evaluation model is to expand data sources and mine existing data to find credit signals.

Use A Modular Architecture

Credit risk evaluation varies on a case-by-case basis. Hierarchical architecture is not suitable anymore. Modular architecture for credit risk evaluation models allows fintech companies to add or remove data sources based on the creditor risk. Using this model, banks can gather financial information from multiple data sources and assign scores based on the importance of data to evaluate creditworthiness.

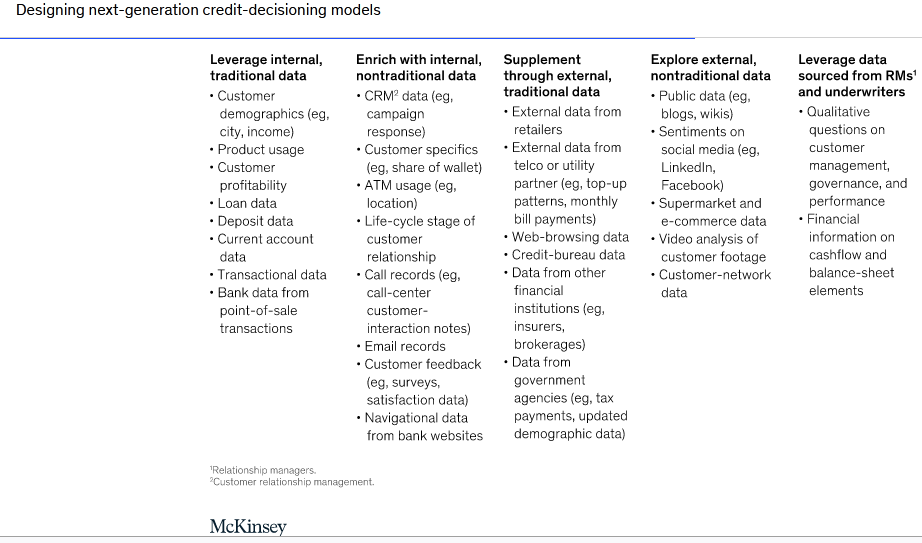

Gather Data From Multiple Data Sources

The decision-making model should have a predictive analysis capacity to evaluate credit risk. The future risk of a creditor can be evaluated using historical data. Apart from traditional data, use non-traditional and external data for underwriting.

Use Data Mining To Identify Credit Signals

While the data sources are useful, the true potential of credit risk evaluation models can only be unlocked with proper data mining tools. Data from multiple sources must be pulled together, compared and analysed to identify credit signals. Modern-day ML models can take incomplete or partial banking data and predict the customers’ outlook for categorisation. This helps in segmentation based on geographical location, past financial history, etc.

Leverage Fintech Expertise

While credit risk evaluation is crucial, NBFCs need not spend their resources building a brand-new credit risk evaluation model. They can leverage the technical and cloud expertise of fintech partners to build upon the evaluation model they already have. As the new models are modular, banks can determine the type of evaluation modules necessary based on the target market.