Digital banking in India is expected to grow with a CAGR of 23.1% from 2022 to 2030. NBFC growth is also estimated to hit $5 trillion in 2024. E-Banking existed as an additional service before COVID-19. However, after the pandemic, globally, the concept of Internet banking has changed. Indian banks have achieved phenomenal growth by adopting digital technologies. Banks hope to have a multi-dimensional relationship with customers to improve banking services.

Upcoming Digital Banking Trends

As digital banking continues to grow, it opens up new opportunities to reach the underserved market. Rural India has numerous small businesses and cottage industries that can thrive well with futuristic funding options. However, it was difficult for banks to reach out to those consumers. The following digital banking trends will bring financial services and products closer to the rural parts of the country as well:

Mobile Banking

According to a study, 89% of consumers use mobile banking services. Mobile wallets are also increasingly adopted by rural India due to the widespread growth of digitisation. Security is often a major concern for mobile banking users. Mobile banking has reached 5X growth compared to online banking. Mobile banking will gain even more popularity as the number of millennials and Gen Z customers increases.

Emerging Trend Of Neobanks

Neobanks are growing at a rapid pace in India. These neobanks operate digitally without any physical branches. They are great alternatives to traditional banks, offering innovative products and reaching out to underserved markets. Due to RBI regulations, Neobanks partners with traditional banks to extend customer services.

BaaS

The banking As A Service (BaaS) sector is causing major disruption in the fintech industry. Instead of building every service from scratch, it is much easier for NBFCs (Non-Banking Financial Companies) to set up Neobanks using the BaaS platform. The neobank technology stack can be customised according to the goals and needs of NBFCs. Partnering with a BaaS provider such as Niyogin, neobanks can offer services using the APIs. They can build on the infrastructure platform already complete with rails that can easily connect with rural customers.

Innovative Technologies

According to Insider Intelligence Survey, 66% of banking professionals believe that newer technologies such as Artificial Intelligence (AI), blockchain, and the Internet of Things (IoT) will positively impact banking by 2025. AI is now widely used in credit risk evaluation, customer authentication, and customer support. Blockchain technology will also help financial institutions cut down middlemen and reduce operational costs.

Challenges For Future Digital-Only Banks

Currently, RBI has a strict regulatory framework for digital banks. Digital banks must comply with liquidity standards and capital adequacy similar to commercial banks. Initially, these banks can get a restricted license, and after proving their efficiency, they can upgrade their license. To avail of digital banking services, customers need computer literacy. This is one of the main challenges for digital banks interested in providing services to rural India. Also, the need for secure banking services is also on the rise.

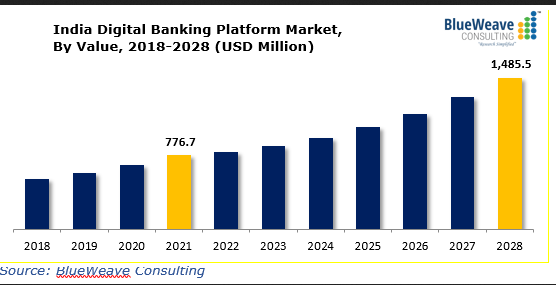

The digital banking platform market is expected to reach $1485.5 million by 2028, from $776.7 million in 2021. Currently, 26% of Indians have a digital bank account, which is expected to grow in the future. RBI is also creating a closed sandbox environment for digital banking services. The budget has also carved some space for digital bank units, which is a clear sign of progression for the Indian banking sector.

A fintech partner like Niyogin will help banking institutions easily transition from legacy systems to modern and advanced banking technology for futuristic customers.