India’s fintech sector has been one of the key drivers behind the rise of embedded finance. With its massive population, diverse financial needs, and high mobile penetration, India is an ideal market for this transformation. The combination of government support, digital infrastructure which aims to provide financial services to underserved communities, and the proliferation of smartphones has created an environment ripe for the growth of embedded finance. However, the opportunities are vast. As mobile penetration increases and fintech adoption continues to rise, embedded finance can play a crucial role in accelerating financial inclusion, especially among India’s large unbanked and underbanked populations. By providing easy access to essential financial products, India’s fintech sector can unlock new economic opportunities for millions. Conclusion The rise of embedded finance represents a paradigm shift in how financial services are delivered and consumed. With its seamless integration into everyday platforms, it offers convenience, personalization, and greater financial inclusion. India’s fintech sector, with its rapidly advancing digital infrastructure, is well-positioned to capitalize on the opportunities offered by embedded finance, ultimately transforming the financial landscape for millions of citizens. As the sector continues to evolve, it will be crucial for businesses, regulators, and consumers to collaborate in overcoming challenges, safeguarding security, and unlocking the full potential of this transformative trend.

Tag: fintech

How Gen AI is Revolutionizing Customer Experience in Fintech

Generative AI is rapidly reshaping industries, and fintech is no exception. By utilizing the power of AI, fintech companies are redefining customer experiences, making financial services more accessible, personalized, and efficient. Personalized Financial Advice One of the most significant impacts of Gen AI on fintech is the ability to provide highly personalized financial advice. AI-powered chatbots and virtual assistants can analyze vast amounts of data, including transaction history, spending patterns, and risk tolerance, to offer tailored recommendations. For instance, a chatbot can suggest investment opportunities aligned with a user’s financial goals or recommend budgeting strategies to optimize cash flow. A recent study by Capgemini found that 71% of consumers are willing to share their financial data with AI-powered tools in exchange for personalized advice. This growing trust in AI-driven solutions underscores the potential for Gen AI to revolutionize financial planning and advisory services. Enhanced Customer Support Gen AI-powered chatbots and virtual assistants are transforming customer support in the fintech industry. These AI-driven tools can handle a wide range of inquiries, from simple account balance checks to complex troubleshooting. By automating routine tasks, these tools free up human agents to focus on more complex issues, improving overall customer satisfaction. Moreover, AI can analyze customer sentiment in real-time, allowing businesses to identify and address potential issues proactively. This proactive approach can significantly reduce customer frustration and churn. Fraud Detection and Prevention Fraudulent activities pose a significant threat to the fintech industry. Gen AI can play a crucial role in detecting and preventing fraud by analyzing vast amounts of transaction data in real-time. AI algorithms can identify anomalies and suspicious patterns that may indicate fraudulent activity, enabling financial institutions to take swift action to protect their customers. A study by Juniper Research estimates that AI-powered fraud prevention solutions could save the financial services industry $8 billion by 2026. Seamless User Experiences Generative AI is revolutionizing the fintech industry by enabling companies to deliver seamless, intuitive, and highly personalized user experiences. For instance, AI-powered voice assistants allow users to effortlessly interact with their financial accounts using natural language, streamlining the process of managing finances on the go. Moreover, AI-driven personalization tailors the user interface to individual preferences, offering customized recommendations and services that significantly enhance user engagement and satisfaction. By leveraging these advanced AI technologies, fintech companies are not only improving convenience but also creating a more dynamic and user-centric financial environment. The Future of Fintech As generative AI continues to evolve, its transformative impact on the fintech industry is poised to expand significantly. By embracing this technology, fintech companies can unlock exciting new opportunities, enhance customer experiences, and gain a substantial competitive advantage. While it’s important to address ethical considerations and ensure responsible and transparent AI usage, the potential for growth is immense. With the power of AI, fintech companies can build deeper, more meaningful relationships with their customers, foster trust, and drive sustained long-term success.

The Future of Fintech: How Gen AI is Reshaping the Industry

Generative Artificial Intelligence or Gen AI as we call it is rapidly reshaping the fintech landscape, offering significant advancements that are transforming financial services across the globe. As AI models become more advanced, they are driving the next generation of fintech innovations, improving customer experiences, optimizing operational efficiency, and enhancing security protocols. By analyzing vast amounts of data and automating complex processes, Gen AI is poised to redefine the way financial institutions and fintech companies interact with customers and make strategic decisions. 1. Personalized Financial Advice Gen AI leverages vast data sets, including spending habits, income, and economic trends, to deliver highly personalized financial advice, such as customized investment strategies, retirement planning, and budgeting solutions. It can also forecast market movements and recommend adaptive strategies, helping clients make informed decisions. Furthermore, AI-powered virtual assistants and chatbots provide real-time, 24/7 customer support, delivering tailored responses, resolving specific concerns, and offering proactive guidance. This enhances customer satisfaction by ensuring fast, accurate, and accessible service at any time, creating a seamless and personalized experience. 2. Automated Financial Processes AI-driven automation is transforming back-office operations within the fintech industry by streamlining tasks that were traditionally time-consuming and manual. Processes like loan processing, fraud detection, and compliance checks are now being automated, enabling financial institutions to operate more efficiently and accurately. AI can analyze vast and complex data sets in real-time, identifying patterns and anomalies that human teams might miss, thus enhancing decision-making and reducing the risk of errors. This capability extends to optimizing risk management by assessing creditworthiness, predicting potential risks, and fine-tuning investment strategies with greater precision. The result is a more efficient operation that reduces costs, improves regulatory compliance, and delivers better financial outcomes for both institutions and customers. By leveraging AI, fintech companies can enhance their service offerings, respond faster to market changes, and provide more personalized, data-driven financial solutions. 3. Enhanced Security and Fraud Prevention AI is revolutionizing fintech by bolstering security and fraud prevention. By analyzing vast amounts of transaction data in real-time, AI can swiftly identify anomalies and suspicious patterns, enabling swift action to thwart fraudulent activities. This proactive approach significantly reduces financial losses and builds trust between financial institutions and their customers. Furthermore, AI acts as a vigilant guardian of sensitive financial information. By continuously monitoring networks and systems, AI can proactively identify vulnerabilities, predict potential attacks, and deploy countermeasures before damage occurs. 4. Innovative Financial Products AI is driving the evolution of fintech by enabling the creation of personalized financial products and innovative business models. From tailored insurance policies and investment portfolios to predictive analytics for risk assessment and AI-powered trading platforms, Gen AI is reshaping the financial landscape, delivering more relevant and efficient solutions. The Road Ahead The future of fintech powered by Gen AI looks promising. As AI technologies continue to evolve, they will become even more integrated into financial services, driving innovation, efficiency, and customer satisfaction. Financial institutions and fintech companies that embrace AI will be better equipped to meet the demands of an increasingly digital, data-driven world. However, the challenges associated with AI adoption—particularly in the areas of data privacy, ethics, and regulation—must be carefully managed to ensure that the benefits of this technology can be fully realized. By addressing these concerns, the fintech industry can build a more efficient, inclusive, and customer-centric future for financial services. As we look to the future, the full potential of AI in reshaping the financial landscape will continue to unfold, ushering in an era of smarter, more personalized, and more efficient financial services.

Compliance for Fintech under RBI’s guidelines

By Prabal Goel, Chief Compliance Officer – Business & Legal In recent years, the financial technology (fintech) sector has seen exponential growth, revolutionizing the way we conduct financial transactions and manage our money. However, with innovation comes the need for regulation to ensure consumer protection, financial stability, and market integrity. In India, the Reserve Bank of India (RBI) plays a pivotal role in overseeing the fintech industry, setting guidelines and regulations to promote a safe and efficient ecosystem. Compliance with RBI’s guidelines is essential for fintech firms to thrive in this rapidly evolving landscape. RBI’s regulatory framework for fintech encompasses various aspects, including licensing, data protection, outsourcing, KYC, digital lending and customer due diligence. In recent years, RBI has been increasingly vigilant in assessing the compliance of fintechs with the regulations issued by RBI and has been proactive in taking measures to tackle non-compliance. RBI regulates fintechs through a variety of instruments, including by use of Regulations (both statutory and non-statutory), Circulars (including Master Circulars), Circular Letters, Directions (including Master Directions), Guidelines, Policy Statements, Guidance Notes, Press Releases, Standards, Mailbox clarifications, Advisories, D.O. Letters, and General Instructions. A lot of these regulations govern certain types of fintechs directly; examples of these regulations would be NBFC – Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 which governs P2P lending platforms. Sometimes, RBI regulates indirectly by regulating the banks and NBFCs associated with them. We see this in operation in the case of Directions on Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs, whereby RBI governs the party outsources any activities, generally performed by itself, to some other party. RBI also constituted Regulations Review Authority 2.0 in 2021 in order to enable ease of compliance. This demonstrates an active push to ensure that the RBI is a step ahead of the curve to facilitate orderly growth of the banking and finance sector without curbing innovation. On the other hand, RBI has becoming increasingly tight in ensuring consumer due diligence and ensuring that the regulated entities follow RBI KYC norms scrupulously. Increasingly, RBI has reiterated its commitment towards ensuring no tolerance towards persistent non-compliance with its norms. Achieving and maintaining compliance with RBI’s regulatory guidelines can, sometimes, be a complex and challenging task for fintech firms, especially for startups and smaller players with limited resources and expertise and more particularly, in a business environment where the governance has, regrettably, had a history of prioritizing business revenues and efficiency ahead of compliance. To navigate the regulatory landscape effectively, fintech companies must invest in robust compliance frameworks, engage with regulatory authorities, and stay abreast of regulatory developments and updates. It is in this light that RegTech or the technology which makes regulatory compliance more efficient through automated processes and lowers the costs of compliance, acquires lot of currency. It is anticipated that in coming years, RegTech would assume a vital role in the operations of several fintechs. The key drivers of RegTech have been and are expected to be technologies based around cloud computing, Big Data, API and most importantly, blockchain. The biggest roadblock to wider adoption of RegTech is the competencies around knowledge of the regulatory requirements. It is often seen that especially in case of regulatory interpretation, there are often ambiguities and despite the adoption of best drafting practices, even contradictions between regulations. In a business environment driven by startups with less than ideal compliance culture, reliance on RegTech, particularly cheap RegTech, can be disastrous, since such RegTechs may often have skimped on developing the regulatory knowhow. Again, a RegTech which provides solutions tempered by several qualifications about its capabilities, may not really be solving modern fintech regulatory compliance problems. Nevertheless, RegTech has the potential in standardized environments, which is reflected in the projected jump to the tune of 4 times its current valuation by 2028- the valuation of the industry, by some estimates, in 2023 is $1.37 billion in 2023 and is expected to swell to $6.64 billion by 2028. Whether this projected increase is ever achieved will be a question that time will answer, but one thing is certain- the success of RegTech as a method to achieve compliance will be determined by the agility of RegTech to keep pace with the ever-changing regulatory requirements.

Fintech: Disruption or Collaboration?

The financial services sector is experiencing a significant shift due to the rapid progress of technology and the rise of innovative fintech solutions. Players in the industry face both opportunities and challenges as fintech transforms traditional banking and financial practices. Let us view the dynamics of fintech disruption and collaboration, highlighting the key trends and implications for the future of finance. The Emergence of Fintech Disruption Customer-Centric Solutions: Customer-centric solutions have helped fintech disruptors gain traction. They provide seamless, individualized, and practical financial services by utilizing mobile technologies, artificial intelligence, and advanced analytics. This change puts pressure on established financial institutions to change and improve their clientele’s experience. Blockchain Technology and Cryptocurrencies: These innovative financial tools have made transactions safe and transparent by introducing decentralized financial systems. They are upending established banking models, but they also present regulatory risks and uncertainties. The distinction between traditional and digital finance is becoming hazier as central banks investigate the integration of digital currencies. Alternative Lending Platforms: Traditional lending methods have been upended by fintech companies that specialize in crowdfunding and peer-to-peer lending. By eschewing traditional banks, these platforms give individuals and small businesses quicker access to capital. This has forced well-known financial institutions to reconsider how they lend money. Robo-Advisors: Wealth management has undergone a significant transformation with the emergence of robo-advisors, which provide automated and algorithm-driven investment advice. Traditional financial advisors are facing competition from fintech disruptors who have drawn in a new generation of investors. The industry is seeing a convergence of human expertise and robo-advisory to offer hybrid solutions. Fintech Collaboration: Partnerships with Incumbents: A lot of fintech companies understand the benefits of working with well-established financial institutions. Through partnerships, fintech companies can reach a wider range of consumers, and traditional banks can take advantage of cutting-edge technologies without having to make major changes to their current infrastructure. Regulatory Compliance Solutions: To improve openness and compliance with legal requirements, fintech companies are working with regulators and compliance specialists. By working together, we can make sure that technology progresses in line with moral and legal requirements, which will make the financial system safer and more stable. Initiatives for Open Banking: Open banking frameworks promote cooperation by granting third-party fintech companies access to bank customer data (with permission). As a result, innovation is encouraged, and new financial services and products can be developed while protecting the confidentiality and security of client data. Collaboration Across Industries: Fintech disruption goes beyond traditional finance and fosters cooperation with the tech, telecom, and e-commerce sectors. Synergies from partnerships spur innovation and broaden the financial services industry’s reach. The fintech ecosystem is characterized by a dynamic interplay between cooperation and disruption. Disruptive technologies upend established norms, but cooperation between fintech companies and traditional institutions is essential for managing regulatory complexities and guaranteeing the financial sector’s long-term stability. The future looks to be one of peaceful coexistence as innovation and cooperation propel the development of finance, ultimately serving the interests of both enterprises and consumers.

How are Regulatory changes impacting Fintech?

In the dynamic realm of fintech, regulatory changes have become a driving force reshaping the landscape and influencing the trajectory of innovation. The intersection of finance and technology is undergoing a profound transformation, with regulatory bodies adapting to the evolving nature of digital finance. As financial technology continues to redefine traditional banking and payment systems, the regulatory framework plays a pivotal role in either facilitating or constraining the growth of fintech enterprises. Regulatory changes have a big impact on the fintech business. The authorities and governments worldwide are constantly upgrading and adjusting their regulatory frameworks to keep up with the evolving fintech landscape. The Reserve Bank of India (RBI) recently announced new regulations targeted at tightening lending norms on unsecured loans, sending vibrations across the fintech sector. This development represents a fundamental shift in the regulatory landscape, affecting how fintech companies operate and expanding their influence over the developing unsecured lending industry. Here are a few examples of how regulatory changes affect the fintech industry: Licensing and Compliance To operate lawfully, fintech companies are frequently required to get licenses and follow rules. Changes in licensing requirements, compliance standards, and reporting duties can impose additional expenses and administrative constraints on fintech enterprises. Consumer Protection Regulators strive to safeguard consumers from potential hazards linked with fintech services, such as fraud, data breaches, or predatory loan practices. To promote consumer protection, regulatory changes may impose new requirements for transparency, security, and dispute resolution. Data Security Fintech firms frequently deal with sensitive client data. Regulatory reforms, such as the General Data Protection Regulation (GDPR) of the European Union or comparable data protection legislation in other countries, put severe limitations on how data can be gathered, stored, and utilized, hurting fintech business models that rely on data-driven insights. AML and KYC Regulations AML and KYC requirements apply to fintech organizations, particularly those involved in payments and digital currencies, to prevent money laundering and terrorist financing. Regulatory changes in this area may affect customer onboarding and continuing monitoring. Payment Services and Digital Currencies Fintech firms that provide payment services or digital currencies may face specific regulatory changes, such as those related to cryptocurrencies, central bank digital currencies (CBDCs), and open banking, impacting their operations, interoperability, and competition. Crowdfunding and Peer-to-Peer Lending Changes in rules governing crowdfunding and peer-to-peer lending platforms can influence fundraising, lending, and investment activities. Regulatory reforms may impose investment limitations, disclosure requirements, and investor protection safeguards. Regulatory Sandboxes Some regulatory bodies set up fintech sandboxes, which allow companies to test new products and services while receiving regulatory relief. These sandboxes can serve as a haven for fintech innovation. Cross-border legislation Fintech firms frequently operate across borders, and dealing with differing foreign legislation can be difficult. Regulatory changes affecting cross-border payments, remittances, and financial services can have a substantial impact on the worldwide expansion efforts of fintech companies. Market Entry and Competition Regulatory changes can support or hinder market entry for fintech startups and existing enterprises. Depending on the regulatory framework, some modifications may lessen entry barriers, while others may favour incumbents. Cybersecurity and Resilience Fintech enterprises must comply with cybersecurity and operational resilience rules to protect against cyber threats and assure the continuity of vital financial services. Therefore, fintech firms must manage the complicated regulatory landscape efficiently, stay updated about evolving legislation, modify their business models, and invest in compliance. Depending on how these changes are implemented and managed, they can both generate opportunities for innovation and pose obstacles for fintech organizations.

The Ethics of Data Sharing in Fintech

Over the last decade, the fintech industry has grown at an exponential rate, revolutionizing how we manage, invest, and transact money. The use of enormous volumes of data is crucial to this transition. Fintechs use data to deliver personalized services, decrease risks, and improve efficiency. However, this rapid evolution creates significant ethical concerns about data sharing in the fintech business. They need to consider the ethical considerations surrounding data sharing and strike a balance between innovation and privacy in the following ways: Consent with Knowledge Obtaining informed consent from users is one of the fundamental foundations of ethical data sharing in the fintech industry. Users should be properly informed about the data being gathered, how it will be used, and who will have access to it. Individuals can make informed decisions about sharing their data because of this transparency. Fintech firms must ensure that consent is not buried in lengthy terms and conditions but rather offered in a straightforward and accessible manner. Data Protection The protection of financial data is critical. Fintech organizations must protect consumer data from breaches and unauthorized access. A breach not only jeopardizes people’s privacy, but it can also have serious financial consequences. To protect sensitive information, ethical data sharing necessitates sophisticated encryption, authentication, and cybersecurity procedures. Data Reduction Fintech companies should only gather and exchange data that is required for their services. The ethical principle of data minimization states that businesses should avoid gathering excessive or irrelevant information. Companies can lower the risk of data exploitation and increase user confidence by adhering to this approach. Third-party sharing Fintechs frequently interact with third-party service providers and share client data to improve their offers. Ethical concerns arise here since these third parties may not share the same commitment to data protection. To guarantee that data sharing meets ethical standards, these firms must thoroughly screen and monitor the practices of their partners. Anonymization and de-identification of data Data anonymization and de-identification techniques can be used by firms to preserve user privacy. This entails deleting or masking personally identifiable data from data collections. While this method can help to retain privacy, it is not without flaws, and there is always the potential for re-identification. To fulfill growing ethical requirements, fintech firms must constantly examine and improve their strategies. Fair and Non-Discriminatory Use Data should not be used to discriminate against individuals based on their colour, gender, age, or other protected characteristics, according to ethical data sharing. To avoid perpetuating bias and discrimination, algorithms that use data for decision-making must be rigorously evaluated. Fintech companies must ensure that their services are available and equitable to all. Accountability and Regulation To preserve ethical standards in data sharing, fintechs should develop explicit policies and procedures for data processing. Furthermore, they must hold themselves accountable for any data breaches or misuse and cooperate with regulatory organizations. Government regulations and industry norms are critical to establishing the ethical foundation for data sharing. Above all, the fintech industry’s inventive use of data has the potential to revolutionize financial services and improve people’s lives. Finding the correct balance between innovation and privacy is critical to ensuring that companies perform responsibly in their data-sharing practices. Finally, the success of the fintech industry is dependent not only on cutting-edge technology but also on ethical data-sharing practices that foster trust and respect for individuals’ rights.

Robo-Advisors vs. Human Advisors: Finding the Right Balance for Your Financial Future

In the ever-changing landscape of financial advising and investment management, two separate techniques have arisen as rivals for the title of the most effective and efficient means of managing your wealth: Robo-advisors and Human advisors. Both have their unique strengths and weaknesses and choosing the right option can significantly impact your financial well-being. Understanding Robo-Advisors The algorithms of Robo-advisors are based on modern portfolio theory and diversified asset allocation methodologies, making them an efficient and low-cost solution. Here are some of the primary benefits of Robo-advisors Cost-effective: Robo-advisors frequently offer more economical fees than traditional human advisors, making them a cost-effective option for investors. Accessibility: They are available 24 hours a day, seven days a week, allowing you to monitor your investments and make changes at any time. Diversification: Robo-advisors develop diversified portfolios based on data-driven insights, lowering risks and optimizing returns. Impartiality: Robo-advisors make investing judgments based on data rather than emotion. However, Robo-Advisors have limitations: Lack of Personalization: They may not evaluate your specific financial circumstances, goals, and risk tolerance as thoroughly as human consultants. Limited Human Interaction: Robo-advisors can be impersonal and lack the personal touch of people who appreciate human engagement. Understanding Human advisors Human advisors, on the other hand, are skilled experts who give personalized financial advice and investment management. They have the following benefits: Personal Guidance: Human advisors adapt their recommendations to your individual financial goals, risk tolerance, and life circumstances. Emotional Support: They can provide emotional support amid market volatility and assist you in being disciplined in your financial strategy. Financial Planning: Human advisors provide comprehensive financial planning services such as tax preparation, estate planning, and retirement planning. Adaptability: They can respond quickly to shifting market conditions and alter your investing strategy accordingly. Human advisors, on the other hand, also have a few drawbacks: Higher Fees: Their services are frequently more expensive, and fees may be a portion of your assets under management. Bias: Some human advisors may have conflicts of interest, resulting in suggestions that benefit them more than their clients. How to find the right balance between these two? The decision between robot advisors and human advisors is not binary. Many investors believe that a hybrid approach is the best solution. Here are some things to keep in mind: Your financial objectives: A Robo-Advisor may be sufficient if you have simple investment demands and long-term ambitions. If your financial position is more complicated, a human advisor can provide tailored advice. Risk Tolerance: If you are risk averse and want guidance during volatile markets, a human advisor’s emotional support may be invaluable. Cost: Consider your financial situation. Robo-advisors are less expensive, whereas human advisors provide a more thorough but more expensive service. Time: Consider how much time you can devote to managing your money. Robo-advisors demand less direct supervision. Finally, a balanced approach that integrates both digital automation and human experience may deliver the best of both worlds. You can make an informed selection that is in line with your financial future if you understand the benefits and drawbacks of each option. The goal is to focus on what will best suit your needs and financial well-being in the long run.

The Future of Digital Payments in India

With the introduction of new technology and the government’s aim for a cashless economy, digital payments in India have seen a remarkable transition in recent years. The Indian digital payment ecosystem is rapidly expanding, providing millions with ease, security, and financial inclusion. Here are a few trends, statistics, and examples that illustrate the evolving payment landscape. Mobile Payments Revolution The emergence of mobile payments has been one of the most significant transformations in India’s digital payment landscape. Mobile wallets such as Paytm, Google Pay, and PhonePe have become household names. The volume of PPI payments in India in fiscal year 2022 accounted for approximately 6.58 billion which included mobile wallets. The growing use of mobile payments has made transactions more accessible and convenient for both urban and rural communities. Unified Payments Interface (UPI) UPI has emerged as a game changer in India’s digital payment ecosystem. Developed by the National Payments Corporation of India (NPCI), it allows users to transfer money quickly from their bank accounts to any other bank account, 24 hours a day, seven days a week. In June 2023, the UPI payments system processed 9.34 billion transactions worth 14.75 lakh crore. The success of UPI has spurred other countries to investigate similar systems, underscoring India’s pioneering role in digital money. QR Code Payments QR code payments are just another innovation that has changed the way people make payments. QR codes have been used for payment by businesses of various kinds, from street vendors to large organizations. Customers simply scan a QR code, enter the amount, and finish the transaction. According to Ernst & Young, QR code payments will account for 9.4% of all digital payments by 2025. This technology has made digital payments available to people who do not have cell phones or internet connections. Financial Inclusion Digital payments have played a critical role in extending financial services to India’s unbanked and underbanked communities. The Jan Dhan Yojana, a government project, has encouraged financial inclusion by providing bank accounts for millions of people. The Reserve Bank of India’s financial inclusion index (FI) increased from 56.4% to 60.1% in 2022–23 (April–March) due to improvements in usage and quality dimensions, a substantial improvement over prior years. Gig Economy and E-Commerce The rise of e-commerce platforms and the gig economy have contributed to the increase in digital payments. Amazon and Flipkart, as well as ride-sharing services Uber and Ola, have integrated digital payment systems into their apps, making it easier for consumers and gig workers to interact. This pattern is predicted to continue, with the Indian e-commerce business expected to reach $120 billion by 2025. Regulatory Framework India’s government and regulatory organizations have been engaged in building a favourable climate for digital payments. Initiatives such as the “Digital India” campaign, Aadhaar-based e-KYC, and the implementation of the Goods and Services Tax (GST) have streamlined the digital payment ecosystem, making it more secure and transparent. The future of digital payments in India looks bright, with a focus on innovation, convenience, and financial inclusion. As more Indians accept digital payments, the landscape is poised to evolve, generating opportunities for both businesses and consumers. With a population of over a billion people, India’s digital payment revolution has the potential to set a global standard for digital finance.

India’s Changing Fintech Ecosystem

In recent years, India’s fintech ecosystem has undergone a spectacular transition, revolutionizing how financial services are accessed and delivered. The convergence of technology, shifting customer tastes, and supportive legislative actions have resulted in a dynamic and diverse fintech ecosystem. From payments and loans to wealth management and insurance, the industry’s rapid expansion has not only boosted financial inclusion but also paved the way for creative solutions catering to a wide range of customers. The emergence of fintech in India can be attributed to a number of elements coming together. One of the key motivators has been the phenomenal growth of smartphones and internet connectivity, particularly in rural areas. This digital flow has produced a massive client base with access to digital financial services. Digital payments and Remittances With the launch of the Unified Payments Interface (UPI), India’s digital payments market has undergone a seismic upheaval. UPI has streamlined peer-to-peer transactions, allowing for quick and smooth money transfers. This innovation has not only reduced reliance on cash but has also accelerated the adoption of digital wallets and mobile banking apps. Furthermore, the government’s demonetization campaign in 2016 served as a spark, encouraging more individuals and companies to accept digital payments. Online Lending India’s ancient banking system frequently denied formal credit to a large segment of the population. Fintech platforms filled this void with novel loan strategies. These platforms analyze creditworthiness and distribute loans quickly by leveraging alternative data sources and smart analytics, making lending available to both individuals and small businesses. Investment and Wealth Management Fintech has democratized wealth management by giving consumers platforms to invest in stocks, mutual funds, and other financial instruments. Robo-advisors have gained popularity by providing algorithm-driven investing recommendations suited to individual risk profiles. This trend has made it easier and less expensive for regular investors to participate in the capital markets. Insurtech The insurance industry has also been transformed by fintech. Insurtech businesses use data analytics, artificial intelligence, and IoT devices to customize insurance policies, speed claim processing, and improve customer experience. This has made insurance products more accessible, inexpensive, and responsive to customer needs. Challenges and Opportunities Despite its rapid growth, the Indian fintech ecosystem faces certain challenges. Data security and privacy concerns, regulatory uncertainties, and the need for constant innovation are some of the hurdles that industry players must navigate. Additionally, ensuring financial literacy and digital literacy among the masses remains critical to harnessing the full potential of fintech. However, the possibilities are numerous. The government’s “Digital India” program and initiatives such as the “Jan Dhan Yojana” have paved the way for a financially egalitarian digital environment. Collaborations between established financial institutions and fintech firms can help deliver more comprehensive and efficient services by using each other’s capabilities. Regulatory Outlook India’s regulatory organizations have taken an aggressive stance towards fintech. The Reserve Bank of India (RBI) has implemented policies to encourage innovation while maintaining financial stability. The regulatory framework allows financial firms to test their ideas in a controlled environment, stimulating innovation while limiting risks. Furthermore, the RBI’s rules on digital KYC and data localization indicate the authorities’ commitment to balancing innovation and security. India’s fintech sector has grown from a niche market to a significant force altering the country’s financial environment. The convergence of technology, creativity, and regulatory support has enabled fintech to overcome gaps, increase financial inclusion, and improve the efficiency of financial services. As the ecosystem matures, collaboration, innovation, and regulatory vigilance will be the cornerstones of its continuous growth, ultimately leading to a more inclusive and digitized financial future for India.

Modern Age Fintech Products Are Gaining Traction

Modern-day fintech solutions have seen a phenomenal rise in popularity and usage in recent years. These cutting-edge financial solutions are revolutionizing the way individuals and organizations handle their finances. Several significant elements are responsible for fintech’s quick growth: Fintech is increasingly accessible to people of all ages. Fintech apps that aid money management and investment are popular among Generation Z. Millennials are tech-savvy, and they are rapidly becoming interested in financial goods. Boomers are learning to use mobile apps as well, but they prefer the safer financial products they are accustomed to. Neobanks’ hyper-personalized products In 2022, Indian neobanks’ funding increased fivefold. Its investments are estimated to total $215 billion by 2023. Neobanks are popular among Gen Z workers who have recently entered the labour sector. They prefer individualized financial solutions that are both innovative and rewarding. Traditional banks are also considering Neobank agreements to provide hyper-personalized goods. AI-Based Digital lending The Buy Now, Pay Later trend is gaining traction because it offers a much better alternative to the elusive credit card. Digital loans are rapidly expanding, with more than $9 billion invested in the last five years. Banks can increase their reach thanks to AI-based credit evaluation and assessment technology. As financial inclusion becomes more viable, financial institutions will be able to attract more consumers. To accommodate rising credit demand, the banking sector is swiftly innovating, but the shift must be approached with caution and proper capital buffers. New-Age Wealth Tech Digital banking is dramatically disrupting investment products in India. Baby boomers preferred to invest in physical assets. Gen Z now wishes to gain more from financial markets by utilizing digital payments. The number of active Demat accounts climbed by 63% in 2022, reaching 89.7 million. These cutting-edge tools streamline investment options by allowing access to mutual funds, peer-to-peer investing, equities, and everything else. Again, AI-based investing recommendations ensure that the younger generation can invest like an expert without having to acquire all the jargon. Alternate Funding Platforms Instead of relying on traditional banks and investments, startups are now seeking fresh and innovative finance methods. Crowdfunding platforms enable individuals to collect funds to address their financial requirements. Many banks, too, are active in crowdsourcing. Small businesses and start-ups that have obstacles with traditional finance methods prefer to use these crowdfunding solutions. Asset and Portfolio Management using Robo Advisors Asset and portfolio management with robo-advisors is predicted to grow at a CAGR of 22.11% from 2023 to 2027. The number of users will exceed 44.949 million. The COVID-19 pandemic impacts are responsible for the huge increase in robo-advisors. They manage a user’s portfolio by assessing their financial condition, future goals, level of risk, and other preferences. Leading financial institutions are collaborating with AI firms to develop powerful robo-advisors that can eliminate the need for human participation. Depending on their demands, the user can select fund-based, equity-based, or overall wealth advisory. Modern-day fintech products are clearly altering the financial environment as they gain traction. Their ability to fill existing gaps in traditional financial services, along with their capacity for ongoing innovation, places them at the vanguard of the changing way we handle, access, and interact with our money.

How Rural Businesses Can Tap into Fintech in India?

The fintech market in India has been rapidly changing over the past few years, providing a considerable opportunity for rural businesses to improve their financial operations and growth prospects. By utilizing fintech, rural businesses in India can experience dramatic transformations and close the gap between conventional financial services and contemporary digital innovations. In India, about 11.7% of adults do not own a bank account. Meanwhile, the Financial Inclusion Index in India is 56.4 based on ease of access, usage, lack of service, and inequality. Even though actions taken by the Reserve Bank of India and the Jan Dhan Yojana by the Prime Minister of India increased the number of people with bank accounts from the rural parts of the country, statistics show that over 85% of the bank accounts held by the marginalized or rural folks are non-functional and inactive. Here are a few ways rural businesses can leverage fintech: Digital Payments and Transactions: Fintech provides mobile payment apps and digital wallets that enable secure and immediate transactions, minimizing the need for cash. Through this convenience, rural enterprises can streamline operations and increase their consumer base. Online lending platforms: A lot of fintech platforms offer unconventional lending choices that make use of cutting-edge techniques for credit evaluation, allowing small enterprises in rural areas to access financing without the requirement for conventional collateral. This can encourage investment and business expansion. Insurance Solutions: Fintech can deliver streamlined, individually designed insurance policies that are suited to the special needs of rural businesses and offer defense against a range of threats. Access to Investment Platforms: Investment platforms can help rural enterprises by providing information and chances to invest extra money, possibly earning extra income. Government Programmes and Subsidies: By streamlining the application process for government incentives and subsidies, fintech can make sure that rural enterprises get the help to which they are entitled. Education and Awareness: Financial technology firms frequently offer instructional materials and training on how to utilize their platforms efficiently, enabling rural businesses to make the most of these capabilities. Rural firms should first determine their unique needs and explore the available fintech solutions before attempting to leverage fintech. It’s crucial to pick platforms that are user-friendly, safe, and compatible with the objectives of the company. Developing digital literacy among stakeholders and staff is also essential for successful adoption. Rural businesses in India can open new doors for expansion, financial inclusion, and increased sustainability by embracing fintech.

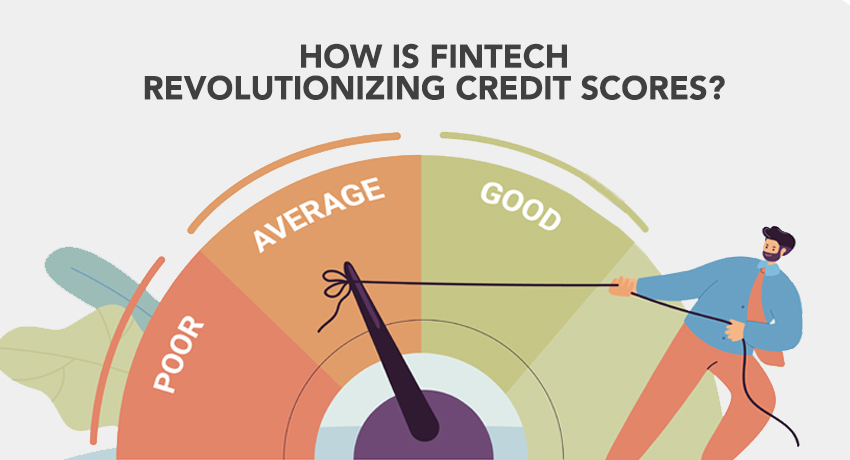

How is Fintech Revolutionizing Credit Scores?

The fintech revolution has impacted the financial industry in a variety of ways, with credit scoring being one of the most disruptive. Credit scores have traditionally been established using restricted data, frequently omitting people with little or no credit history. However, with the rise of fintech, forward-thinking businesses are using technology, alternative data sources, and advanced analytics to revolutionize credit ratings. Image Source: Google Fintech changing credit scores and its benefits to consumers and lenders Increasing Data Sources Fintech firms are leveraging the power of technology to access data sources other than traditional credit agencies. Fintech firms may provide a more comprehensive image of an individual’s creditworthiness by examining a broader range of data, such as utility bills, rent payments, and even social media activity. As a result, they can now measure creditworthiness for people who were previously underserved by the standard credit scoring paradigm. Inclusion of unbanked and underbanked individuals One of the primary benefits of fintech-driven credit scoring is its capacity to include people who are unbanked or underbanked. These people may have limited access to standard financial services and no official credit history. Fintech firms can use alternative data and creative scoring models to assess creditworthiness based on criteria such as income, savings patterns, and transaction history. This inclusion gives underprivileged people access to credit and financial services that were previously unavailable to them. Improved Accuracy and Risk Assessment Fintech’s data-driven approach to credit scoring improves risk assessment accuracy. Traditional credit ratings frequently focus mainly on payment history, ignoring important aspects like income, education, and employment history. These extra data points can be incorporated into fintech models to create a more comprehensive assessment of an individual’s creditworthiness. This enables lenders to make better-informed decisions and provide personalized lending packages customized to the specific demands and circumstances of each borrower. Speed and Efficiency Fintech firms use innovative technologies and automation to streamline the credit evaluation process. They can analyze vast amounts of data quickly and deliver near-instant credit judgements by utilizing algorithms and machine learning. This speed and efficiency benefit both lenders and borrowers by lowering the time and effort required to acquire credit while reducing the danger of human error. Facilitating Financial Inclusion The significance of fintech-driven credit scoring in fostering financial inclusion is one of its most important achievements. Fintech companies are breaking down barriers and boosting access to finance for previously underrepresented populations by leveraging alternative data sources and advanced analytics. Individuals will be able to establish credit, get inexpensive loans, and engage more fully in the economy as a result of this inclusion, leading to increased financial empowerment and economic prosperity. Fintech is transforming credit ratings through the use of technology, alternative data sources, and advanced analytics. This game-changing strategy broadens the pool of people who can obtain credit, empowers the unbanked and underbanked, and improves the accuracy and efficiency of credit evaluation. Financial inclusion is being promoted through fintech-based credit scoring, which ensures that more people have access to affordable loans and financial services. The credit scoring landscape will continue to alter as the fintech revolution proceeds, empowering individuals and transforming the way creditworthiness is assessed.

Fintech and Digital Currencies: Exploring the Potential of Central Bank Digital Currencies

The emergence of financial technology (fintech) in recent years has transformed the way we conduct financial transactions. The rise of digital currencies is one of the most significant developments in the fintech industry. While cryptocurrencies such as Bitcoin have gained popularity, central banks around the world are investigating the possibilities of central bank digital currencies (CBDCs). So, here we explore the potential of CDBCs. Financial Inclusion and Banking Service Access CBDCs have the ability to address the difficulties of financial inclusion by offering universal access to basic financial services. Individuals who do not have traditional bank accounts can use CBDCs to get a digital wallet that is directly linked to the central bank, allowing them to engage in the digital economy and access important financial services. This empowers unbanked and underbanked people while also encouraging economic growth and decreasing disparities. Efficiency and Cost-cutting CBDCs can streamline financial transactions by minimizing middlemen and associated expenses by harnessing the benefits of block chain technology. Real-time settlement and instant peer-to-peer transactions are conceivable, removing the need for third-party payment processors and lowering transaction fees. This increased efficiency can benefit firms, consumers, and governments alike, boosting economic growth and decreasing friction in the financial system. Financial Stability and Regulation CBDCs strengthen central banks’ visibility and control over financial transactions. The use of block chain technology allows for increased monitoring capabilities, which aid in the discovery of illegal acts such as money laundering and fraud. Furthermore, CBDCs can serve as an additional policy tool for managing monetary policy, thereby enhancing financial stability and resilience. Transactions and Remittances Across Borders CBDCs have the potential to make cross-border transactions more efficient, transparent, and cost-effective. CBDCs can efficiently facilitate remittances, which are critical for many developing economies, by decreasing fees and delays associated with traditional money transfer systems. This has the potential to boost economic growth and enhance the livelihoods of individuals and families who rely on remittances. Innovation and the Fintech Ecosystem CBDCs can promote innovation in the fintech environment. CBDCs enable the development of smart contracts and decentralized apps (DApps) by offering a programmable infrastructure, thereby opening up new possibilities for automated financial services and novel financial solutions. This fosters technical developments and a thriving fintech sector. Key Principles of CDBCs Indian Digital Currency Program The Reserve Bank of India (RBI) launched a digital rupee pilot programme in the wholesale sector, on November 1, 2022. Our Indian Digital Currency (IDC) would be used as a cryptocurrency in our country. This digital money would give our country’s economy a boost and help it grow. What is the RBI’s take on CBDC? A redesigned and computerized form of physical currency, similar to sovereign paper currency. Exchangeable at par with present currency and acknowledged as a medium of payment. A lawful tender and a safe deposit of value. Conclusion Central Bank digital currencies have the potential to transform the financial landscape, providing several benefits ranging from financial inclusion and efficiency to improved regulatory supervision. However, CBDC deployment necessitates careful consideration of a number of aspects, including privacy problems, cybersecurity, scalability, and interoperability with existing financial systems. Collaboration between policymakers, financial institutions, and technological specialists is critical as central banks throughout the world continue to explore and trial CBDC projects. To exploit the revolutionary potential of CBDCs while resolving issues and ensuring that digital currencies contribute to a more egalitarian, efficient, and sustainable financial future, an inclusive and transparent strategy is required.

Asset-Backed Securities and Fintech: Opportunities and Challenges in 2023

Asset-backed securities (ABS) have long been a popular financial vehicle for securitizing and diversifying the risks associated with diverse underlying assets. The rise of fintech has introduced new opportunities and challenges to the ABS market in recent years. Fintech firms are transforming the way ABS are originated, structured, and traded by exploiting innovative technologies and alternative data sources. Opportunities Access to Diversified Asset Classes Fintech platforms are enabling the securitization of assets other than typical mortgages and auto loans. Peer-to-peer loans, small business loans, supply chain finance, and even revenue streams from subscription services can now be securitized using fintech-driven ABS. This expansion provides investors with new investment choices and helps issuers diversify their funding sources. Greater Efficiency and Transparency Fintech solutions are improving the ABS origination and structuring process, increasing efficiency, and lowering costs. Blockchain technology, for example, offers safe and transparent asset ownership documentation, allowing for faster settlements and lowering counterparty risks. Smart contracts automate payment flows and enforce pre-set rules, ensuring accuracy and removing the need for middlemen. These technical advances result in improved operational efficiency and transparency throughout the ABS’s lifespan. Improved Risk Assessment and Pricing Fintech platforms use advanced data analytics and artificial intelligence to improve risk assessment and pricing models for ABS. Fintech companies may produce more accurate and dynamic risk assessments for underlying assets by analyzing massive volumes of data, including alternative data sources. This better risk assessment enables more exact pricing of ABS, which benefits both investors and issuers. Challenges Regulatory Compliance: Fintech-driven ABS raises new regulatory issues. Compliance with existing securities regulations, investor protection requirements, and privacy legislation remain important factors for fintech firms. Regulators are adapting to the changing landscape, but firms in the fintech sector may be required to demonstrate adequate risk management frameworks, data protection measures, and compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. Cybersecurity and data security threats: Data security and cybersecurity threats grow increasingly obvious as fintech platforms collect and analyze massive volumes of sensitive data for ABS origination and administration. It is critical to maintain data privacy and protect against cyber dangers. Fintech companies must invest in robust security measures, conduct frequent security audits, and follow industry best practices to prevent these risks. Investor Education and Trust: The incorporation of fintech into ABS necessitates educating investors on the new structures and technology involved. Building trust in fintech-driven ABS requires transparency in data sources, risk assessment processes, and underlying technology. Providing clear and accessible disclosures regarding ABS’s assets, risks, and potential returns will be critical for investor confidence. Fintech’s inclusion in the asset-backed securities market brings both opportunities and concerns in 2023. Fintech platforms increase access to a broader range of assets, improve efficiency and transparency, and improve risk assessment and pricing methods. However, regulatory compliance, data security, and investor education are critical problems that must be solved to ensure the long-term sustainability of fintech-driven ABS. As the fintech industry evolves, collaboration among regulators, fintech businesses, and market participants will be critical to realizing the full potential of fintech in the asset-backed securities market.

The Rise of Digital Identity Verification in Fintech Credit

Digital identity verification has evolved as an important component of credit evaluation processes in the fast-paced world of financial technology (fintech). Traditional methods of verifying identities for credit applications, such as manual document checks and in-person verification, are time-consuming, error-prone, and out of step with today’s customer expectations. Fintech firms are utilizing cutting-edge technologies and digital solutions to revolutionize identity verification, thereby improving security, efficiency, and customer experience. What is Digital Identity Verification? A digital identification service is a process that allows consumers to securely access their financial and legal information. We can easily communicate and protect our personal and sensitive information by using identity verification services. Advantages of Digital ID in Fintech and Online Banking Exceptional Customer Service Customers benefit from a seamless experience since digital identification verification simplifies and streamlines the credit application procedure. Fintech companies may verify identities in seconds by leveraging technology like face recognition, biometrics, and artificial intelligence (AI), eliminating the need for clients to provide physical documents or visit a physical location. This frictionless experience improves client happiness and increases credit application conversion rates. Improved Security and Fraud Prevention Digital identity verification improves security and reduces the danger of identity theft and fraud. Fintech companies can use advanced technologies to validate identification documents, identify tampering or forgery attempts, and undertake liveness checks to guarantee the person presenting the identity is physically present. These strong security measures safeguard both customers and lenders, lowering the likelihood of fraudulent activity in the credit ecosystem. Access to Previously Untapped Markets Credit availability to traditionally underserved populations, such as the unbanked and underbanked, could be expanded with digital identity verification. Traditional credit assessments frequently rely on traditional credit bureau data, which excludes people who do not have a formal credit history. Fintech organizations can assess creditworthiness based on characteristics such as payment history, income, and transaction patterns by leveraging alternative data sources and advanced analytics. This inclusion helps underserved people obtain credit and establish financial profiles, thereby promoting financial inclusion and economic empowerment. Regulatory Compliance Fintech firms operate in a highly regulated environment, and adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements is critical. Digital identity verification systems assist in satisfying these compliance standards by automating identity checks, certifying document authenticity, and completing risk assessments. These digital solutions ensure that fintech organizations meet regulatory requirements, lowering compliance risks and increasing operational efficiency. Scalability and Cost effectiveness Manual identity verification techniques are time-consuming, labour-intensive, and not scalable. To handle increasing numbers of credit applications, fintech organizations require nimble and efficient solutions. By automating the verification process and eliminating the need for manual involvement, digital identity verification provides scalability and cost effectiveness. Because of this scalability, fintech firms can manage a larger volume of credit applications while keeping expenses under control. Steps to Create a Trusted Digital Identity: – Digital identity verification is altering the financial credit market by providing a transformational approach to identity verification. Fintech firms are improving consumer experiences, tightening security measures, expanding loan access, maintaining regulatory compliance, and improving operational efficiency by employing sophisticated technologies. The rise of digital identity verification is changing the way credit applications are processed, decreasing friction, increasing security, and promoting financial inclusion. As the fintech sector evolves, digital identity verification will remain a critical component in offering seamless and secure credit experiences for individuals and organizations alike.

The Rise of Regtech: Fintech’s Response to Regulatory Compliance

The fintech business has grown significantly in recent years, revolutionizing traditional banking and finance. However, as fintech firms continue to disrupt the market, they face an important challenge: regulatory compliance. To meet this challenge, a new industry has formed called Regtech. Regtech, or regulatory technology, is a term that refers to the use of new technologies to expedite and automate compliance processes, allowing fintech companies to effectively navigate complicated regulatory landscapes. Fintech companies operate in a highly regulated environment, subject to different laws and regulations set by governmental entities such as financial authorities and regulatory agencies. These policies are intended to safeguard customers, prevent financial crimes, preserve data privacy, and promote market stability. Compliance with these standards is not only required but also vital in establishing trust and confidence with consumers and investors. Traditional compliance approaches can be time-consuming, resource-intensive, and error-prone. With their agile and technology-driven approach, fintech start-ups recognized the need for more efficient and automated compliance solutions. They realized that traditional approaches could not handle the massive amounts of data generated in the digital age. The Emergence of Regtech Regtech emerged as a solution to these traditional compliance approaches, employing emerging technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and big data analytics. Regtech solutions provide fintech organizations with tools and platforms to automate compliance processes, improve risk management, and ensure compliance with regulatory standards. Benefits of Regtech for Fintech Companies Efficiency and Automation: Regtech solutions automate labour-intensive compliance procedures, minimizing human errors and enhancing operational efficiency. This automation enables businesses to devote resources to more strategic operations. Real-time Monitoring and Reporting: Regtech platforms provide real-time monitoring and reporting of compliance activities, facilitating proactive detection and resolution of compliance concerns. This assists fintech organizations in staying on top of their regulatory duties and demonstrating their commitment to compliance. Improved Risk Management: Regtech solutions use advanced analytics to spot possible hazards and irregularities in data, transactions, and customer behaviour. Fintech organizations can improve their fraud detection and prevention capabilities by integrating risk management tools. Cost Reduction: Traditional compliance procedures can be costly, particularly for small and medium-sized fintech organizations. Regtech solutions offer cost-effective alternatives by eliminating the need for manual operations and lowering regulatory penalties associated with noncompliance. Regulatory Collaboration and Standardization: Regtech benefits both fintech start-ups and regulatory agencies. It enables authorities to more efficiently and effectively monitor compliance, resulting in a more transparent and stable financial ecosystem. Furthermore, the industrywide use of standardized regtech solutions promotes consistency and streamlines compliance requirements for financial start-ups. As fintech continues to disrupt the financial industry, compliance with regulatory standards remains a vital aspect of success. Regtech has emerged as a critical enabler, allowing fintech companies to manage the complicated regulatory landscape swiftly and effectively. Regtech solutions expedite compliance processes, improve risk management, and save costs by integrating cutting-edge technology. As the fintech industry evolves, the collaboration between Regtech and regulators will be critical to maintaining trust, integrity, and innovation in the financial ecosystem.