Wealth Management has been an invariable part of society. From saving money in piggy banks to saving it in bank accounts, society has always had the ‘Save The Money’ ideology. With evolution, the brick-and-mortar model of savings converted into tech-driven options that we know today as WealthTech where individuals can save and invest through a paperless and digitized process.

Since its inception, Wealth Tech has experienced steady adoption and growth. But with the pandemic, the bet on Wealth Tech grew immensely.

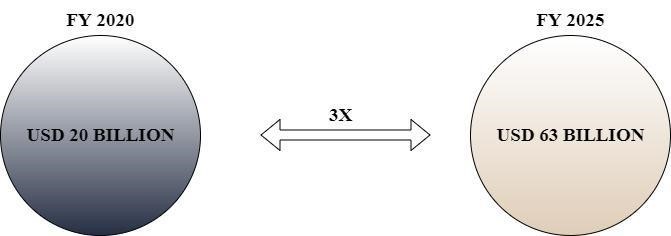

The diagram shows the immense potential Wealth Tech holds. As per the diagram, by FY25, Wealth Tech is estimated to grow 3 times its current value reaching a whopping USD 63 billion!

Changes in investor demographics, a new generation of clients who demand customer experience, convenience and functionality have created a whole new area for investment activities. Decades of traditional working have been disrupted by a paperless and digitization approach. Moreover, this has also ensured financial inclusion by bringing the ‘underinvestors’ into the ‘investor club’.

Wealth Tech has propelled a change in the market which ensued as a result of creating a digital ecosystem. Furthermore, by adjoining robust cybersecurity and keeping pace with market threats, Wealth Tech is steadily commenting on its hold in the market.

Starting with personal investments, Wealth Tech is leveling up by targeting institutional clients as well. If they achieve a breakthrough, Wealth Tech can experience winning opportunities in the market.

Wealth Tech providers understand the changing era and the demand for DIY investment options. Therefore, by allowing the market to have exactly what they demand, Wealth Techies are offering self-serve solutions and enabling the investors to grow their investments, take risks and avail profits at their own decisions and pace.

Continued enhancement to meet customer preferences and needs has also acted as a winning point for Wealth Tech. End-to-end process optimization, richer experience, relevance, state of art offerings, etc., has propelled Wealth Tech’s penetration and adoption into the market.

Furthermore, by investing in an agile and lightweight architecture, several Wealth Tech companies are investing in an architecture that can be accessed through APIs or microservices. This allows them to update, change specific functionality or deploy new services into the market as and when required.

Its minimal yet skilled human intervention at locations ensures a data-driven approach yet a personalized effect. Robo-services help in advising, reporting and wealth planning while human intervention helps in customer acquisition, customer support, client retention, etc.

Although Wealth Tech has witnessed steady growth overall, the growth has been well-planned and strong. By creating a digital ecosystem, Wealth Tech companies are leaving very little space for non-fulfillment and collapse.