The availability and use of inexpensive financial services by all segments of society is a major driver of economic growth and poverty alleviation. In a varied and large country like India, achieving comprehensive financial inclusion has unique problems. However, the Business Correspondent (BC) model has emerged as a revolutionary force, bridging the gap between traditional banking services and the underprivileged population by leveraging technology and creativity. Let us view how the Business Correspondent concept is helping to increase financial inclusion in India.

Understanding the Business Correspondent Model

The Business Correspondent model is a framework that enables banks to extend their reach and supply financial services to rural and unbanked areas through intermediaries known as Business Correspondents. These correspondents function as bank representatives and conduct various financial transactions on behalf of the bank, bringing official financial services closer to the doorsteps of those who previously had restricted access.

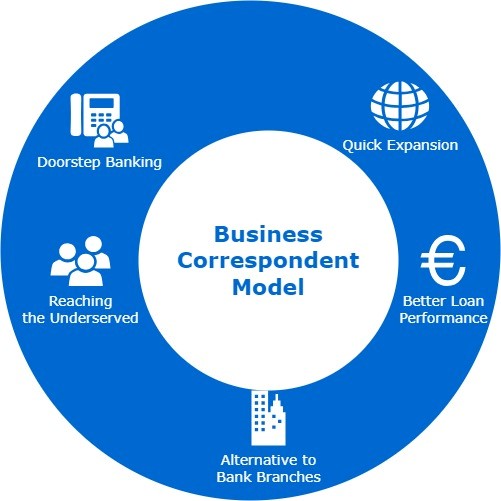

Key Benefits of the Business Correspondent Model

- Improved Accessibility: The Business Correspondent approach makes use of the existing network of local agents, such as Kirana store owners, post offices, and self-help groups, to operate as Business Correspondents. These agents are integrated into the areas they serve, increasing access to financial services for rural and underserved people.

- Technology-Led Approach: The BC model’s emphasis on harnessing technology to deliver financial services efficiently is one of its pillars. BCs allow secure and convenient banking services in places with limited physical infrastructure by using biometric identification, mobile banking, and smart card-based transactions.

- Financial Education and Awareness: Business correspondents play an important role in increasing financial literacy among the unbanked. They help individuals understand the necessity of formal financial services and empower them to make informed financial decisions by guiding them through the benefits of savings, credit, and insurance products.

- Credit Access for the Unbanked: The BC model makes it easier to extend loans to individuals and small enterprises that were previously excluded from mainstream banking systems. Business Correspondents help financial institutions give microloans and credit facilities to the underserved by completing detailed evaluations and using digital records, thereby boosting entrepreneurship and economic progress.

- Government Programs and Subsidies: The BC model has proven useful in executing numerous government initiatives and ensuring the proper distribution of subsidies and benefits. Business Correspondents serve as a critical link between beneficiaries and government organizations, enabling frictionless transactions and decreasing leakages in welfare programs.

Challenges and Prospects:

While the Business Correspondent approach has helped increase financial access, several issues remain. Infrastructure limits, connectivity issues, and regulatory barriers must be cleared in order to fully exploit the model’s potential. To overcome these challenges, it is critical to strengthen digital infrastructure, extend internet connectivity, and streamline regulatory frameworks.

Furthermore, regular training and capacity-building programs should be established to improve the abilities of Business Correspondents so that they can efficiently provide comprehensive financial services. Financial institutions, technology providers, and legislators must work together to establish an ecosystem that promotes financial inclusion.

Conclusion

The Business Correspondent model has emerged as a game changer in India’s quest for financial inclusion. The BC approach provides cheap banking services to historically marginalized populations by using technology, empowering local agents, and increasing financial literacy. As India continues to make strides in bridging the financial divide, the Business Correspondent model stands as a beacon of hope, paving the way for a more inclusive and prosperous future.