Disruption; an aggregator of a number of changes brought about a change in the banking after the crisis of 2008-2009. The crisis revealed loopholes in the banking system and how technology and innovation was the way forward. Whether newer products and services or operations, innovative technology held the potential to improve the overall scenario in financial institutions and credit unions.

Today, artificial intelligence (AI), machine learning (ML), big data analytics, robotic process automation (RPA), natural language processing (NLP) etc., have all evolved over time and today, this innovative technology is transforming the financial world especially in the customer experience, fraud and risk arena.

Fintechs today are making use of artificial intelligence to curb fraudulent activities, anomalous transactions, risk management etc. However, anomalous activities may not necessarily always be fraudulent in nature; they can also be linked to money laundering. Artificial intelligence has helped minimize the exposure especially since the type of frauds and risks have also evolved with time and technology.

Risk and fraud is an inevitable element of any business or process and Fintechs are devising strategies and services to curb these activities with the help of artificial intelligence.

Risk and fraud is an inevitable element of any business or process and Fintechs are devising strategies and services to curb these activities with the help of artificial intelligence.

Artificial intelligence collects several critical information like IP address, geo-locations, email domains, device information, operating systems, browser agents, phone prefixes etc. Artificial neural network and machine learning algorithms have helped implement these to extract helpful analysis and reports for better performance and risk management thereby, outperforming traditional statistical methods.

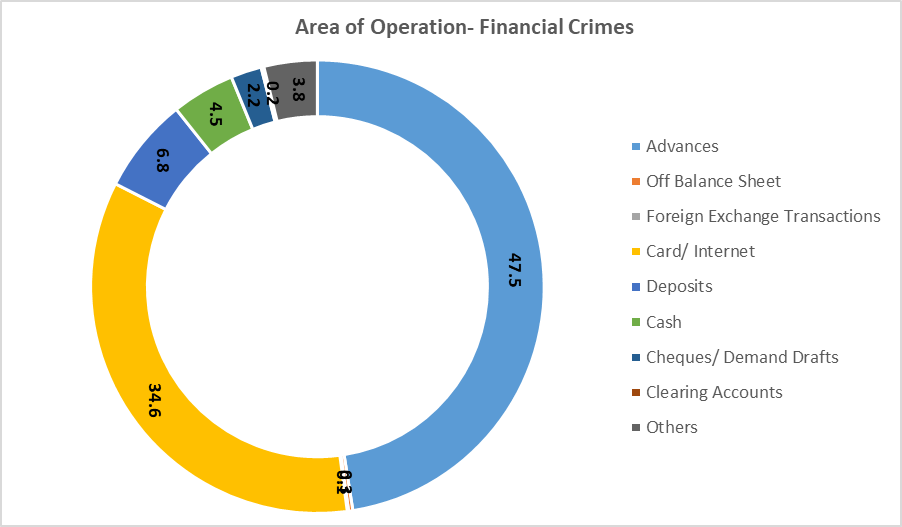

AI in Financial Crimes

Prevention-

As per reports, credit card fraud is the most common type of fraud that results in huge losses each year. While eliminating credit card frauds is difficult, it can be minimized by selecting who you choose to on-board. Depending upon the data it is fed, AI can generate a risk profile of a customer thereby intimating financial institutions of possible risks associated with the customer.

Detection-

Money laundering, a post customer on-boarding element, is a threat to financial institutions. Artificial neural networks have shown improvement in identifying underlying risks by highlighting suspicious patterns. Big data analytics compares current and historical data of customer behaviour, transaction patterns, cash deposits, international transfers etc., thereby assisting financial institutions in earmarking high risk profiles.

AI and Data

Fintechs are fighting fraud and risk through AI and standard ‘data’ is a critical aspect in receiving desirable results. The output of AI depends on the type and quality of data it is fed and therefore, it is essential to have a standard and quality set of data.

The role of artificial intelligence and its sub sets have become a vital part of Fintechs and how they function today. Artificial intelligence has allowed Fintechs to navigate deep water and areas untouched, for instance MSMEs while simultaneously minimizing risks associated with it.

Risk, fraud, money laundering, anomalous transactions are different aspects of financial crime that grips financial institutions and artificial intelligence is helping them navigate this deep water.