Constant innovation, agility and customer centricity have been a strong forte of Fintech. Leveraging its ability to enforce flexibility owing to its downright digital functionality, Fintech has eased common financial-related tasks. Furthermore, the transparency it has brought by eliminating unnecessary intermediaries has helped it gain the trust of end users. These attributes also happen to be the focal point for a one of its kind Fintech, Niyogin.

To be able to enable last mile users is a way of empowering the society for Niyogin! This empowerment comes when individuals can make decisions and undertake their financial tasks. Although the underserved also happen to be the ones with limited digital literacy, Niyogin offers customer-centric services that fill major gaps. Through its diverse digital payment products, Niyogin ensures it designs and launches services that are beneficial to each individual irrespective of demography thereby bringing the population under one net.

Digital Payment Methods

1. Unstructured Supplementary Service Data (USSD)

The majority of the underserved population own a feature phone that is incapable of accessing an internet connection. USSD targets this underserved public by offering them financial service that does not require an internet connection. Individuals can undertake mobile banking transactions, make balance inquiries and access mini statements through USSD channel. This service offers the public a basic financial service essential to their everyday financial task.

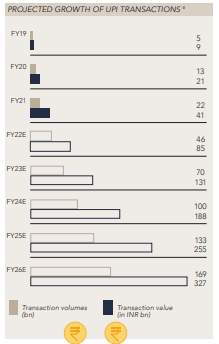

2. BHIM-UPI

The Unified Payments Interface (UPI) is a system that combines several banking services, frictionless fund routing, and merchant payments into a single mobile application (of any participating bank). It also handles ‘Peer to Peer’ collection requests, which can be scheduled and paid for as per the user’s need and convenience. Each bank has its own UPI app available for Android, Windows, and iOS (s).

UPI has enabled several Indians to make payments from anymore to anywhere with a single click. It has reduced our dependency on physical money and therefore created a smoother transaction journey.

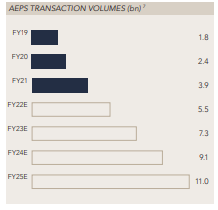

3. AePS Aadhar Enabled Payment System (AePS)

This service goes beyond the need for an internet connection or even a basic feature phone. Individuals residing in the interiors of India are often deprived of basic amenities and owning a phone may come across as a luxury for such individuals. This challenge restricts the masses to access basic financial services and to combat this challenge, AePS was launched.

AePS is a bank-led model that enables online interoperable financial transactions at PoS (Point of Sale/Micro-ATM) using Aadhaar authentication through any bank’s Business Correspondent (BC)/ Bank Mitra.

4. Mobile wallets

A mobile wallet is a device that allows a user to carry cash in a digital form. One can use their mobile device to attach their credit card or debit card information to the mobile wallet application and transfer money to another mobile wallet online. Although the rural population in its entirety may not be the target audience for mobile wallets, however, this comes as a respite for the tech-savvy urban population, especially the millennials and GenZ.

5. Micro-ATMs or m-ATM

MicroATM is a device used by Business Correspondents (BCs) to provide basic financial services in rural areas. BCs are typically local shop owners or Kirana owners impaneled by Niyogin with MicroATMs installed in their stores to enable customers to deposit, withdraw, transfer and make balance inquiries. For the 900 million rural population, financial services were a luxury given the risk and infrastructural challenges attached to servicing them but with innovative devices and strategies, this crowd is being included within the financial realm.

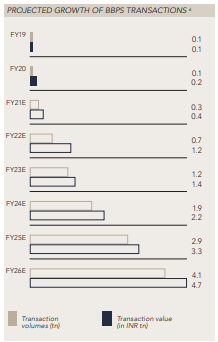

6. Bharat Bill Payment System (BBPS)

The government of India, a critical stakeholder in the development and inclusion of the underserved, are actively taking initiatives towards increasing water and electricity supply in rural areas. This move is expected to propel the growth in utility bill payments. For the last-mile users who have limited to no literacy, assistance in financial-related decisions will prove to be a path to acceptance too.

7. Account Aggregator (AA)

There are several consent managers under the Data Empowerment and Protection Architecture (DEPA), whose main aim is to empower every Indian with control over their data. AA is one of the consent managers exclusively meant for financial data that manage consent for financial data sharing. These consent managers are ‘data blind’ and ensure encrypted data flow. They democratize data access and allow secure portability of confidential data between service providers. With over 65 million migrants hustling outside their origin-village, Domestic Money Transfer is an essential financial service they seek and with the help of AAs, a transparent and secure transaction is a reality for them.

8. Domestic Money Transfer (DMT)

Over 65 million migrants scatter throughout India in search of better opportunities to feed their families. However, because they do not have local bank accounts, money transfers and banking access are difficult for this consumer group. Customers who use DMT- enabled outlets can convert their cash savings and remit them to their own or family’s bank accounts at any time. This service also eliminates unwanted intermediaries, therefore, making the entire process safe.

For the Urban population, digital payments are a necessity whereas, for the rural population, it is a luxury. A lot can be accredited to unequal opportunities, risk and literacy. However, with numerous government initiatives in collaboration with a strong vision Fintech like Niyogin, luxury is slowly changing into an everyday reality for the rural population.