Gold Loan is presently booming and is the fastest-growing loan category amongst the various types of credit offerings in the market. It has witnessed a phenomenal growth opportunity owing to its ease, flexibility and swiftness.

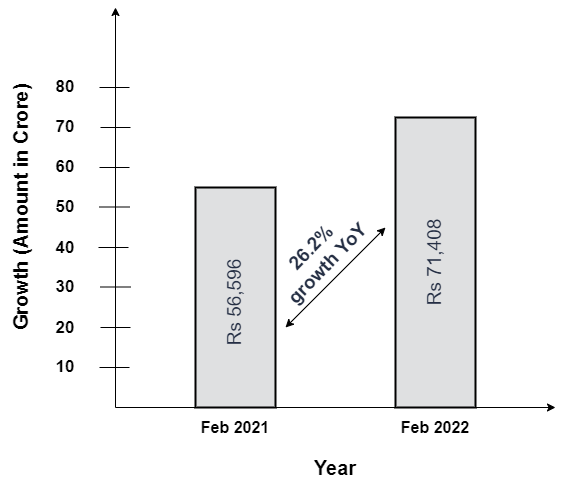

As per Reserve Bank of India’s (RBI) data, the outstanding loan against gold jewelry stood at Rs 56,596 crore as on February 26, 2021 and grew impressively displaying a 26.2% YoY growth. As of 25th February, 2022, it has risen to Rs 71,408 crore.

In 2017, the World Gold Council estimated that Indian households possessed between 24,000 and 25,000 metric tonnes of gold and in 2019, the said estimate was worth as much as 40% of India’s Gross Domestic Product (GDP).

To add to this interesting topic, rural India accounts for 65% of the total estimated gold holdings in India. This data goes on to tell that rural India has great potential if targeted and put to use correctly.

Personal loans are the fastest-growing loan segment of consumer debt. Its market grew by 10-12% over the last 2 years. However, the gold loans market grew 5 times faster in comparison to overall personal loans granted by all banks together. Although gold loan holds just 2% of the total personal loans under bank credit, it is an interesting growth insight especially since the gold loan is superseding personal loans in terms of their acceptability in the market.

So, what has played a major role in this acceptability?

To a certain extent, NBFCs have played a role in this change in statistics. As of date, NBFCs hold a larger block of the gold loan segment. Quick and hassle-free free processes have played a vital role in this switch.

For all other forms of credit, a KYC and strong credit score are a prerequisite but in the case of gold loans, the KYC and credit scoring criteria are comparatively lenient since it is a form of secured loan and the lender has a complete right over the gold that is exchanged in favor of funds. This reduces the risks involved for the lender and is proving to be a preferred method of credit in the market.

Furthermore, since banks are shielded while extending gold loans, they transfer some benefits to the customers too in the form of low-interest rates and if an individual has a strong credit score, the interest rates are brought down further depending upon the lender as it reflects the creditworthiness of the borrower.

Gold loans are secured loans that function solely on the gold you offer. Based on the market price, amount of gold and its purity, the gold rate is estimated and a loan is extended. However, as per RBI guidelines, a lender can extend a maximum of 75% of the gold’s value. This means one’s income, age, credit score and other rigid prerequisites play no role here!

Furthermore, gold loans also help one improve their credit scores in the long run. So it’s a win-win situation for both, the lender and the borrower. One may have an average credit score but since gold is a verifiable and stable market instrument, it acts as a strong collateral for the individual. And, if the individual continues to pay the EMIs on time, it also acts as an enhancer of credit score. Upon repayment, the gold assets will be received in the same weight, state and price that they had been mortgaged for. Since they are placed in triple-layered security storage, the reliability aspect also plays a critical role in its growth.

Conclusion

Several elements have played a role in the agile market growth of gold loans but credit score being no bar is one of the major reasons for its acceptability. It has the potential to serve Urban and Rural populations alike and pull a larger segment of individuals under its wings who can avail of a loan thereby noiselessly paving way for financial inclusion!