Buy Now Pay Later (BNPL) is a form of credit line embedded at the point of sale when customers choose to purchase with the decision to avail of immediate credit. This form of credit line being embedded means customer is not directed to a separate platform for financial services or lenders. The decision is often quick and on the go with limited hard credit checks and no interest fees.

BNPL has gained considerable popularity, especially amongst millennials and Gen Z. It is bringing an all-encompassing change in how we look at and avail of a loan. This drift can be easily attributed to dynamic customer expectations coupled with heavy involvement and acceptance of technology. However, the risks attached to it are real and increasing considering the absence of hard credit checks.

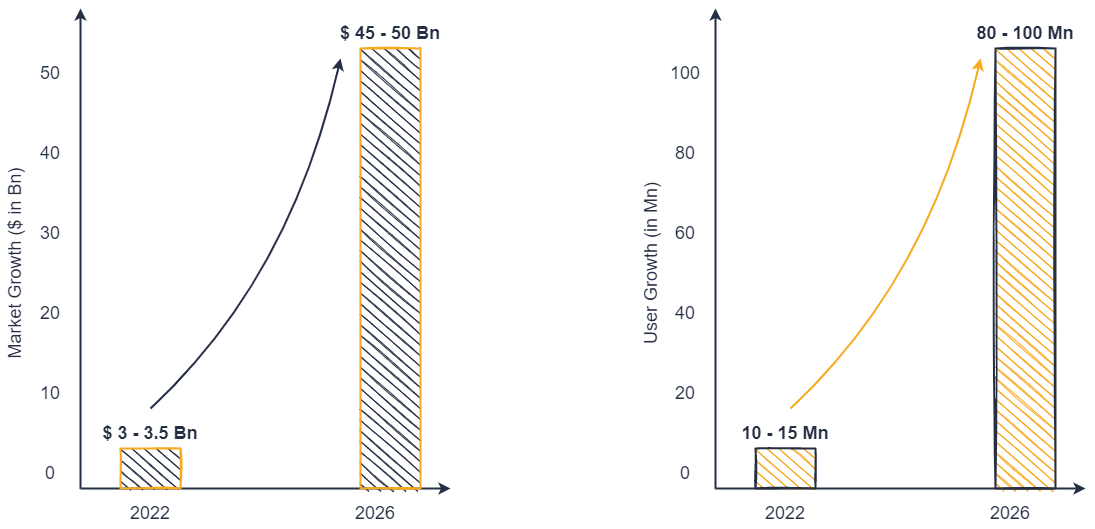

According to a survey, India’s BNPL market stands at $ 3-3.5 billion as of FY 2022 and is projected to touch $ 45-50 billion by FY 2026. Furthermore, the statistics in the number of users is also projected to be on an upward trajectory from 10-15 million in FY 2022 to 80-100 million in FY 2026.

Artificial Intelligence refining BNPL

Ascertaining and analyzing customer preferences requires substantial data which traditional banks own in abundance. These banks benefit from the insight they receive from legacy data with the help of Artificial Intelligence (AI). AI can lead to better customer-centric services; BNPL is a classic example of this statement.

While the notion of availing of a loan and paying installments is not new, BNPL has remodeled the way it is undertaken with the help of open APIs, cloud and artificial intelligence. Its integration has helped create new levels of speed, scalability, agility and security for offered customer platforms.

The rapid gain in acceptance of BNPL also raises legitimate concerns from a regulatory point of view especially since the Indian regulatory framework has not sculpted a concrete policy for Fintech. Areas like credit and background checks, repayable ability and eligibility are and should be of growing concern.

Knowing customers gives financial providers the initial blueprint of services they can offer and design for enhanced CX. However, understanding a customer’s financial personality, i.e., monthly income, spending obligations, past transaction history, job and salary status, etc., in depth is impossible to touch without the help of technology – Artificial intelligence. It allows the bank to retrospect individuals/businesses struggling with cash flow thereby letting the bank manage default risk by marking pre-underwritten credit risk. AI goes on to harness this data and provides a positive impact in the long run.

A typical AI-powered scenario

A classic BNPL purchase is presented with the provider bank’s payment option at the time of checkout. Customers are given options amongst amount, tenure, interest rate, etc as per their needs and convenience. A threshold is created by banks with the help of AI weighing various customer criteria. The customer is only presented with options viable to the bank in terms of risk-taking.

To ensure a win-win situation, AI not only estimates and offers insights to banks but also offers budgeting recommendations, EMI adjustment options, affordability options, etc to the customers.

For financial institutions, especially banks, BNPL is a stream of additional revenue that builds customer loyalty, trust and retention for existing clients while luring new ones with lucrative offers and rewards. Adding AI into the picture has only furthered the growth within a safety net of trustable data-oriented insights. On the other hand, for customers, BNPL is a means of affordable, formal and quick credit line that allows them to enhance their spending threshold and choices. Bringing AI into the picture for the customer means an enhanced customer journey and CX.

Just as technology has penetrated deep into our lives offering service and usage opportunities for each domain, deep-diving into AI-related growth in the financial arena may also offer sustainable growth opportunities within the financial ecosystem.